Test Prep CPA Auditing and Attestation Exam Practice Questions (P. 4)

- Full Access (1025 questions)

- One Year of Premium Access

- Access to one million comments

- Seamless ChatGPT Integration

- Ability to download PDF files

- Anki Flashcard files for revision

- No Captcha & No AdSense

- Advanced Exam Configuration

Question #31

An auditor issued an audit report that was dual dated for a subsequent event occurring after the original date of the auditor's report but before issuance of the related financial statements. The auditor's responsibility for events occurring subsequent to the original report date was:

- ALimited to include only events occurring up to the date of the last subsequent event referenced.

- BLimited to the specific event referenced.

- CExtended to subsequent events occurring through the later date.

- DExtended to include all events occurring since the original report date.

Correct Answer:

B

Choice "b" is correct. When an auditor issues a report that is dual dated for a subsequent event occurring after the original date of the auditor's report, but before issuance of the related financial statements, the auditor's responsibility for events occurring subsequent to the original report date is limited to the specific event referenced.

Choices "a", "c", and "d" are incorrect. The auditor takes responsibility for only the specific event noted in the dual dating and no other event occurring subsequent to the original report date.

B

Choice "b" is correct. When an auditor issues a report that is dual dated for a subsequent event occurring after the original date of the auditor's report, but before issuance of the related financial statements, the auditor's responsibility for events occurring subsequent to the original report date is limited to the specific event referenced.

Choices "a", "c", and "d" are incorrect. The auditor takes responsibility for only the specific event noted in the dual dating and no other event occurring subsequent to the original report date.

send

light_mode

delete

Question #32

When an independent CPA is associated with the financial statements of a publicly held entity but has not audited or reviewed such statements, the appropriate form of report to be issued must include a(an):

- ARegulation S-X exemption.

- BReport on pro forma financial statements.

- CUnaudited association report.

- DDisclaimer of opinion. D

Correct Answer:

Explanation

Choice "d" is correct. When an accountant is associated with the financial statements of a public entity, but has not audited or reviewed such statements, the accountant must issue a report disclaiming any opinion on the statements.

Choices "a", "b", and "c" are incorrect since a disclaimer is required in this case.

Explanation

Choice "d" is correct. When an accountant is associated with the financial statements of a public entity, but has not audited or reviewed such statements, the accountant must issue a report disclaiming any opinion on the statements.

Choices "a", "b", and "c" are incorrect since a disclaimer is required in this case.

send

light_mode

delete

Question #33

Which of the following auditing procedures most likely would assist an auditor in identifying conditions and events that may indicate substantial doubt about an entity's ability to continue as a going concern?

- AInspecting title documents to verify whether any assets are pledged as collateral.

- BConfirming with third parties the details of arrangements to maintain financial support.

- CReconciling the cash balance per books with the cut-off bank statement and the bank confirmation.

- DComparing the entity's depreciation and asset capitalization policies to other entities in the industry.

Correct Answer:

B

Choice "b" is correct. Confirming with third parties the details of arrangements to provide or "maintain (needed) financial support" is an audit procedure that may identify doubts about an entity's ability to continue as a going concern.

Choice "a" is incorrect. Inspecting title documents provides evidence of ownership of assets but would not necessarily identify conditions affecting an entity's ability to continue as a going concern.

Choice "c" is incorrect. Reconciling the cash balance per books with the cut-off bank statement and the bank confirmation provides evidence of completeness and valuation, but would not necessarily identify conditions affecting an entity's ability to continue as a going concern.

Choice "d" is incorrect. Comparing an entity's policies to other entities in the industry would not necessarily identify conditions affecting an entity's ability to continue as a going concern.

B

Choice "b" is correct. Confirming with third parties the details of arrangements to provide or "maintain (needed) financial support" is an audit procedure that may identify doubts about an entity's ability to continue as a going concern.

Choice "a" is incorrect. Inspecting title documents provides evidence of ownership of assets but would not necessarily identify conditions affecting an entity's ability to continue as a going concern.

Choice "c" is incorrect. Reconciling the cash balance per books with the cut-off bank statement and the bank confirmation provides evidence of completeness and valuation, but would not necessarily identify conditions affecting an entity's ability to continue as a going concern.

Choice "d" is incorrect. Comparing an entity's policies to other entities in the industry would not necessarily identify conditions affecting an entity's ability to continue as a going concern.

send

light_mode

delete

Question #34

When an independent CPA assists in preparing the financial statements of a publicly held entity, but has not audited or reviewed them, the CPA should issue a disclaimer of opinion. In such situations, the CPA has no responsibility to apply any procedures beyond:

- ADocumenting that internal control is not being relied on.

- BReading the financial statements for obvious material misstatements.

- CAscertaining whether the financial statements are in conformity with GAAP.

- DDetermining whether management has elected to omit substantially all required disclosures.

Correct Answer:

B

Choice "b" is correct. The accountant is only required to read the financial statements for obvious material misstatements.

Choice "a" is incorrect. The accountant need not document that internal control is not being relied on.

Choices "c" and "d" are incorrect. The accountant is not required to evaluate conformity with GAAP, but any known departures (including inadequate disclosure) should be described in the disclaimer.

B

Choice "b" is correct. The accountant is only required to read the financial statements for obvious material misstatements.

Choice "a" is incorrect. The accountant need not document that internal control is not being relied on.

Choices "c" and "d" are incorrect. The accountant is not required to evaluate conformity with GAAP, but any known departures (including inadequate disclosure) should be described in the disclaimer.

send

light_mode

delete

Question #35

When an auditor concludes there is substantial doubt about a continuing audit client's ability to continue as a going concern for a reasonable period of time, the auditor's responsibility is to:

- AIssue a qualified or adverse opinion, depending upon materiality, due to the possible effects on the financial statements.

- BConsider the adequacy of disclosure about the client's possible inability to continue as a going concern.

- CReport to the client's audit committee that management's accounting estimates may need to be adjusted.

- DReissue the prior year's auditor's report and add an explanatory paragraph that specifically refers to "substantial doubt" and "going concern."

Correct Answer:

B

Choice "b" is correct. When an auditor concludes there is substantial doubt about an entity's ability to continue as a going concern for a reasonable period of time, the auditor's responsibility is to consider the adequacy of disclosure about the entity's possible inability to continue as a going concern and include an explanatory paragraph in the audit report.

Choice "a" is incorrect. The auditor would include an explanatory paragraph following the unqualified opinion, or disclaim an opinion due to a material uncertainty.

A qualified or adverse opinion is not appropriate for doubt about an entity's ability to continue as a going concern.

Choice "c" is incorrect. Management's accounting estimates are unrelated to going concern issues.

Choice "d" is incorrect. Going concern issues are considered prospectively. It is not appropriate to reissue a prior audit report if doubt arises about an entity's ability to continue in a future period.

B

Choice "b" is correct. When an auditor concludes there is substantial doubt about an entity's ability to continue as a going concern for a reasonable period of time, the auditor's responsibility is to consider the adequacy of disclosure about the entity's possible inability to continue as a going concern and include an explanatory paragraph in the audit report.

Choice "a" is incorrect. The auditor would include an explanatory paragraph following the unqualified opinion, or disclaim an opinion due to a material uncertainty.

A qualified or adverse opinion is not appropriate for doubt about an entity's ability to continue as a going concern.

Choice "c" is incorrect. Management's accounting estimates are unrelated to going concern issues.

Choice "d" is incorrect. Going concern issues are considered prospectively. It is not appropriate to reissue a prior audit report if doubt arises about an entity's ability to continue in a future period.

send

light_mode

delete

Question #36

Reference in a principal auditor's report to the fact that part of the audit was performed by another auditor most likely would be an indication of the:

- ADivided responsibility between the auditors who conducted the audits of the components of the overall financial statements.

- BLack of materiality of the portion of the financial statements audited by the other auditor.

- CPrincipal auditor's recognition of the other auditor's competence, reputation, and professional certification.

- DDifferent opinions the auditors are expressing on the components of the financial statements that each audited.

Correct Answer:

A

Choice "a" is correct. Reference to another auditor indicates division of responsibility for the audits of the components of the overall financial statements.

Choice "b" is incorrect. Reference to another auditor would not generally be made if the other auditor's portion of the financial statements were immaterial.

Choice "c" is incorrect. The reference in the report is not meant to recognize the qualifications of the other auditor, but simply to divide the responsibility between the two auditors.

Choice "d" is incorrect. The reference to the other auditor would be made regardless of what type of opinion is expressed by each auditor.

A

Choice "a" is correct. Reference to another auditor indicates division of responsibility for the audits of the components of the overall financial statements.

Choice "b" is incorrect. Reference to another auditor would not generally be made if the other auditor's portion of the financial statements were immaterial.

Choice "c" is incorrect. The reference in the report is not meant to recognize the qualifications of the other auditor, but simply to divide the responsibility between the two auditors.

Choice "d" is incorrect. The reference to the other auditor would be made regardless of what type of opinion is expressed by each auditor.

send

light_mode

delete

Question #37

An auditor includes a separate paragraph in an otherwise unmodified report to emphasize that the entity being reported on had significant transactions with related parties. The inclusion of this separate paragraph:

- AIs considered an "except for" qualification of the opinion.

- BViolates generally accepted auditing standards if this information is already disclosed in footnotes to the financial statements.

- CNecessitates a revision of the opinion paragraph to include the phrase "with the foregoing Explanation."

- DIs appropriate and would not negate the unqualified opinion.

Correct Answer:

D

Choice "d" is correct. Emphasis of a matter should be disclosed in an explanatory paragraph appended to an otherwise unqualified opinion.

Choice "a" is incorrect. An "except for" qualification is used for a scope limitation or a departure from GAAP, but not for emphasis of a matter.

Choice "b" is incorrect. The auditor may emphasize a matter even if it is included in the footnotes.

Choice "c" is incorrect. A phrase such as "with the foregoing Explanation" should not be used in an unqualified opinion.

D

Choice "d" is correct. Emphasis of a matter should be disclosed in an explanatory paragraph appended to an otherwise unqualified opinion.

Choice "a" is incorrect. An "except for" qualification is used for a scope limitation or a departure from GAAP, but not for emphasis of a matter.

Choice "b" is incorrect. The auditor may emphasize a matter even if it is included in the footnotes.

Choice "c" is incorrect. A phrase such as "with the foregoing Explanation" should not be used in an unqualified opinion.

send

light_mode

delete

Question #38

When there has been a change in accounting principles, but the effect of the change on the comparability of the financial statements is not material, the auditor should:

- ARefer to the change in an explanatory paragraph.

- BExplicitly concur that the change is preferred.

- CNot refer to consistency in the auditor's report.

- DRefer to the change in the opinion paragraph.

Correct Answer:

C

Choice "c" is correct. If an accounting change has no material effect on the comparability of the financial statements, the auditor does not need to recognize the change in the current year's audit report.

Choice "a" is incorrect. The change would only be referred to in an explanatory paragraph if the effect were material.

Choice "b" is incorrect. The auditor does not explicitly concur with the change in the report.

Choice "d" is incorrect. Even if the change had a material effect, the opinion paragraph would not be affected. The explanatory paragraph would follow the opinion paragraph.

C

Choice "c" is correct. If an accounting change has no material effect on the comparability of the financial statements, the auditor does not need to recognize the change in the current year's audit report.

Choice "a" is incorrect. The change would only be referred to in an explanatory paragraph if the effect were material.

Choice "b" is incorrect. The auditor does not explicitly concur with the change in the report.

Choice "d" is incorrect. Even if the change had a material effect, the opinion paragraph would not be affected. The explanatory paragraph would follow the opinion paragraph.

send

light_mode

delete

Question #39

When single-year financial statements are presented, an auditor ordinarily would express an unqualified opinion in an unmodified report if the:

- AAuditor is unable to obtain audited financial statements supporting the entity's investment in a foreign affiliate.

- BEntity declines to present a statement of cash flows with its balance sheet and related statements of income and retained earnings.

- CAuditor wishes to emphasize an accounting matter affecting the comparability of the financial statements with those of the prior year.

- DPrior year's financial statements were audited by another CPA whose report, which expressed an unqualified opinion, is not presented.

Correct Answer:

D

Choice "d" is correct. Since only single-year financial statements are presented, the fact that another CPA audited the prior year's financial statements is not relevant. Therefore, the auditor would express an unqualified opinion in an unmodified report.

Choice "a" is incorrect. The situation described would result in a qualified opinion or disclaimer of opinion due to a scope limitation.

Choice "b" is incorrect. The situation described would result in an qualified opinion due to inadequate disclosure.

Choice "c" is incorrect. The situation described would result in an otherwise unqualified opinion modified by adding an additional explanatory paragraph after the opinion paragraph.

D

Choice "d" is correct. Since only single-year financial statements are presented, the fact that another CPA audited the prior year's financial statements is not relevant. Therefore, the auditor would express an unqualified opinion in an unmodified report.

Choice "a" is incorrect. The situation described would result in a qualified opinion or disclaimer of opinion due to a scope limitation.

Choice "b" is incorrect. The situation described would result in an qualified opinion due to inadequate disclosure.

Choice "c" is incorrect. The situation described would result in an otherwise unqualified opinion modified by adding an additional explanatory paragraph after the opinion paragraph.

send

light_mode

delete

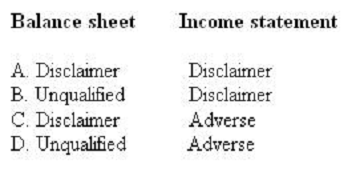

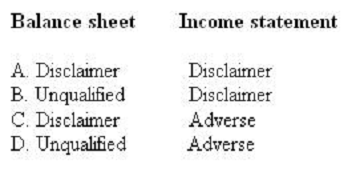

Question #40

Park, CPA, was engaged to audit the financial statements of Tech Co., a new client, for the year ended December 31, 20X3. Park obtained sufficient audit evidence for all of Tech's financial statement items except Tech's opening inventory. Due to inadequate financial records, Park could not verify Tech's January 1,

20X3, inventory balances. Park's opinion on Tech's 20X3 financial statements most likely will be:

20X3, inventory balances. Park's opinion on Tech's 20X3 financial statements most likely will be:

- AOption A

- BOption B

- COption C

- DOption D B

Correct Answer:

Explanation

Choice "b" is correct. When the auditor is unable to satisfy himself or herself regarding the amount of beginning inventory, he or she must disclaim an opinion on the income statement because of the inability to verify the cost of goods sold during the year. The auditor may, however, still be able to issue an unqualified opinion on the balance sheet, since inventory can be verified as of the balance sheet date.

Choices "a", "c", and "d" are incorrect, based on the Explanation above.

Explanation

Choice "b" is correct. When the auditor is unable to satisfy himself or herself regarding the amount of beginning inventory, he or she must disclaim an opinion on the income statement because of the inability to verify the cost of goods sold during the year. The auditor may, however, still be able to issue an unqualified opinion on the balance sheet, since inventory can be verified as of the balance sheet date.

Choices "a", "c", and "d" are incorrect, based on the Explanation above.

send

light_mode

delete

All Pages