Test Prep CPA Auditing and Attestation Exam Practice Questions (P. 3)

- Full Access (1025 questions)

- One Year of Premium Access

- Access to one million comments

- Seamless ChatGPT Integration

- Ability to download PDF files

- Anki Flashcard files for revision

- No Captcha & No AdSense

- Advanced Exam Configuration

Question #21

Which of the following statements is a basic element of the auditor's standard report?

- AThe disclosures provide reasonable assurance that the financial statements are free of material misstatement.

- BThe auditor evaluated the overall internal control.

- CAn audit includes assessing significant estimates made by management.

- DThe financial statements are consistent with those of the prior period.

Correct Answer:

C

Choice "c" is correct. The auditor's standard audit report includes a statement that "An audit includes assessing...significant estimates made by management..."

Choice "a" is incorrect. The standard audit report does not state that disclosures provide reasonable assurance that the financial statements are free of material misstatement. The correct statement is:

"...standards require that we plan and perform the audit to obtain reasonable assurance that the financial statements are free of material misstatement."

Choice "b" is incorrect. The standard audit report does not state that the auditor evaluated the overall internal control. The correct statement is "An audit includes...evaluating the overall financial statement presentation." Internal control is not mentioned in the standard audit report.

Choice "d" is incorrect. The standard audit report does not state "The financial statements are consistent with those of the prior period." According to the second standard of reporting, consistency is implicitly reported. Only if there is an inconsistency is an explicit statement included.

C

Choice "c" is correct. The auditor's standard audit report includes a statement that "An audit includes assessing...significant estimates made by management..."

Choice "a" is incorrect. The standard audit report does not state that disclosures provide reasonable assurance that the financial statements are free of material misstatement. The correct statement is:

"...standards require that we plan and perform the audit to obtain reasonable assurance that the financial statements are free of material misstatement."

Choice "b" is incorrect. The standard audit report does not state that the auditor evaluated the overall internal control. The correct statement is "An audit includes...evaluating the overall financial statement presentation." Internal control is not mentioned in the standard audit report.

Choice "d" is incorrect. The standard audit report does not state "The financial statements are consistent with those of the prior period." According to the second standard of reporting, consistency is implicitly reported. Only if there is an inconsistency is an explicit statement included.

send

light_mode

delete

Question #22

An auditor may not issue a qualified opinion when:

- AAn accounting principle at variance with GAAP is used.

- BThe auditor lacks independence with respect to the audited entity.

- CA scope limitation prevents the auditor from completing an important audit procedure.

- DThe auditor's report refers to the work of a specialist.

Correct Answer:

B

Choice "b" is correct. If the auditor lacks independence with respect to an audit client, the auditor must disclaim an opinion on the financial statements. A qualified opinion is not an option.

Choice "a" is incorrect. A departure from GAAP (which is not sufficiently material to warrant an adverse opinion) may justify a qualification of the auditor's report.

Choice "c" is incorrect. A scope limitation may result in a qualified opinion or a disclaimer of opinion.

Choice "d" is incorrect. The auditor's report may make reference to the use of a specialist only if the specialist's findings result in a change to the auditor's report, such as a qualified opinion.

B

Choice "b" is correct. If the auditor lacks independence with respect to an audit client, the auditor must disclaim an opinion on the financial statements. A qualified opinion is not an option.

Choice "a" is incorrect. A departure from GAAP (which is not sufficiently material to warrant an adverse opinion) may justify a qualification of the auditor's report.

Choice "c" is incorrect. A scope limitation may result in a qualified opinion or a disclaimer of opinion.

Choice "d" is incorrect. The auditor's report may make reference to the use of a specialist only if the specialist's findings result in a change to the auditor's report, such as a qualified opinion.

send

light_mode

delete

Question #23

An auditor most likely would express an unqualified opinion and would not add explanatory language to the report if the auditor:

- AWishes to emphasize that the entity had significant transactions with related parties.

- BConcurs with the entity's change in its method of computing depreciation.

- CDiscovers that supplementary information required by FASB has been omitted.

- DBelieves that there is a probable likelihood of a material loss resulting from an uncertainty that is sufficiently supported and disclosed. D

Correct Answer:

Explanation

Choice "d" is correct. An auditor most likely would express an unqualified opinion and would not add explanatory language to the report if the auditor believes that there is a probable likelihood of a material loss resulting from an uncertainty that is sufficiently supported and disclosed.

Choice "a" is incorrect. Emphasis of a matter, such as the existence of significant transactions with related parties, may result in an additional explanatory paragraph appended to an otherwise unqualified opinion.

Choice "b" is incorrect. A change in accounting principle does result in an additional explanatory paragraph appended to an otherwise unqualified opinion.

Choice "c" is incorrect. Omission of supplemental information required by GAAP does result in an additional explanatory paragraph appended to an otherwise unqualified opinion.

Explanation

Choice "d" is correct. An auditor most likely would express an unqualified opinion and would not add explanatory language to the report if the auditor believes that there is a probable likelihood of a material loss resulting from an uncertainty that is sufficiently supported and disclosed.

Choice "a" is incorrect. Emphasis of a matter, such as the existence of significant transactions with related parties, may result in an additional explanatory paragraph appended to an otherwise unqualified opinion.

Choice "b" is incorrect. A change in accounting principle does result in an additional explanatory paragraph appended to an otherwise unqualified opinion.

Choice "c" is incorrect. Omission of supplemental information required by GAAP does result in an additional explanatory paragraph appended to an otherwise unqualified opinion.

send

light_mode

delete

Question #24

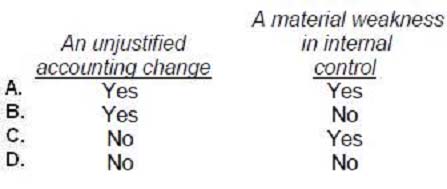

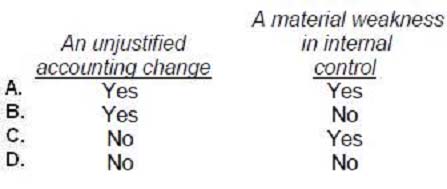

An auditor would express an unqualified opinion with an explanatory paragraph added to the auditor's report for:

- AOption A

- BOption B

- COption C

- DOption D

Correct Answer:

D

Choice "d" is correct. An unjustified accounting change may cause the auditor to issue a qualified or adverse opinion. A material weakness must be reported to management and those charged with governance, but would not be disclosed in an explanatory paragraph appended to an otherwise unqualified opinion.

Choices "a", "b", and "c" are incorrect, as per the above Explanation.

D

Choice "d" is correct. An unjustified accounting change may cause the auditor to issue a qualified or adverse opinion. A material weakness must be reported to management and those charged with governance, but would not be disclosed in an explanatory paragraph appended to an otherwise unqualified opinion.

Choices "a", "b", and "c" are incorrect, as per the above Explanation.

send

light_mode

delete

Question #25

Digit Co. uses the FIFO method of costing for its international subsidiary's inventory and LIFO for its domestic inventory. Under these circumstances, the auditor's report on Digit's financial statements should express an:

- AUnqualified opinion.

- BOpinion qualified because of a lack of consistency.

- COpinion qualified because of a departure from GAAP.

- DAdverse opinion.

Correct Answer:

A

Choice "a" is correct. GAAP allows a company to use different methods for costing different inventories as long as the methods are disclosed. Thus, the audit report would be unqualified; there is no departure from GAAP.

Choice "b" is incorrect. The consistency standard refers to changes in application of accounting practices between periods, affecting the comparability of financial statements. There is no indication Digit made any change in methods.

Choice "c" is incorrect. Use of different methods for costing inventory is permissible under GAAP, and would not result in a qualification of the auditor's report.

Choice "d" is incorrect. Use of different methods for costing inventory is permissible under GAAP, and would not result in an adverse report.

A

Choice "a" is correct. GAAP allows a company to use different methods for costing different inventories as long as the methods are disclosed. Thus, the audit report would be unqualified; there is no departure from GAAP.

Choice "b" is incorrect. The consistency standard refers to changes in application of accounting practices between periods, affecting the comparability of financial statements. There is no indication Digit made any change in methods.

Choice "c" is incorrect. Use of different methods for costing inventory is permissible under GAAP, and would not result in a qualification of the auditor's report.

Choice "d" is incorrect. Use of different methods for costing inventory is permissible under GAAP, and would not result in an adverse report.

send

light_mode

delete

Question #26

In which of the following circumstances would an auditor not express an unqualified opinion?

- AThere has been a material change between periods in accounting principles.

- BQuarterly financial data required by the SEC has been omitted.

- CThe auditor wishes to emphasize an unusually important subsequent event.

- DThe auditor is unable to obtain audited financial statements of a consolidated investee.

Correct Answer:

D

Choice "d" is correct. The inability to obtain audited financial statements of a consolidated investee represents a scope limitation which may result in either a qualified opinion or a disclaimer of opinion.

Choice "a" is incorrect. A material change in accounting principles between periods is disclosed in an explanatory paragraph added to an otherwise unqualified opinion.

Choice "b" is incorrect. Omission of selected quarterly data required by SEC regulations is disclosed in an explanatory paragraph added to an otherwise unqualified opinion.

Choice "c" is incorrect. Emphasis of a matter is disclosed in an explanatory paragraph added to an otherwise unqualified opinion.

D

Choice "d" is correct. The inability to obtain audited financial statements of a consolidated investee represents a scope limitation which may result in either a qualified opinion or a disclaimer of opinion.

Choice "a" is incorrect. A material change in accounting principles between periods is disclosed in an explanatory paragraph added to an otherwise unqualified opinion.

Choice "b" is incorrect. Omission of selected quarterly data required by SEC regulations is disclosed in an explanatory paragraph added to an otherwise unqualified opinion.

Choice "c" is incorrect. Emphasis of a matter is disclosed in an explanatory paragraph added to an otherwise unqualified opinion.

send

light_mode

delete

Question #27

Management of Edgington Industries plans to disclose an uncertainty as follows:

The Company is a defendant in a lawsuit alleging infringement of certain patent rights and claiming damages. Discovery proceedings are in progress. The ultimate outcome of the litigation cannot presently be determined. Accordingly, no provision for any liability that may result upon adjudication has been made in the accompanying financial statements.

The auditor is satisfied that sufficient audit evidence supports management's assertions about the nature and disclosure of the uncertainty. What type of opinion should the auditor express under these circumstances?

The Company is a defendant in a lawsuit alleging infringement of certain patent rights and claiming damages. Discovery proceedings are in progress. The ultimate outcome of the litigation cannot presently be determined. Accordingly, no provision for any liability that may result upon adjudication has been made in the accompanying financial statements.

The auditor is satisfied that sufficient audit evidence supports management's assertions about the nature and disclosure of the uncertainty. What type of opinion should the auditor express under these circumstances?

- AUnqualified without an explanatory paragraph.

- B"Subject to" qualified.

- C"Except for" qualified.

- DDisclaimer of opinion.

Correct Answer:

A

Choice "a" is correct. The note presented describes an uncertainty that is properly discloseD. An explanatory paragraph is not required in the unqualified opinion.

Choice "b" is incorrect. A "subject to" qualified opinion should never be issued.

Choice "c" is incorrect. Since the auditor is satisfied that the assertion and disclosure are supported by the existing evidence, a qualified opinion is not required.

Choice "d" is incorrect. Since the auditor is satisfied that the assertion and disclosure are supported by the existing evidence, there is no need for the auditor to disclaim an opinion.

A

Choice "a" is correct. The note presented describes an uncertainty that is properly discloseD. An explanatory paragraph is not required in the unqualified opinion.

Choice "b" is incorrect. A "subject to" qualified opinion should never be issued.

Choice "c" is incorrect. Since the auditor is satisfied that the assertion and disclosure are supported by the existing evidence, a qualified opinion is not required.

Choice "d" is incorrect. Since the auditor is satisfied that the assertion and disclosure are supported by the existing evidence, there is no need for the auditor to disclaim an opinion.

send

light_mode

delete

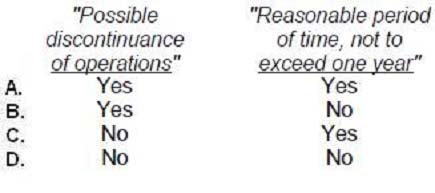

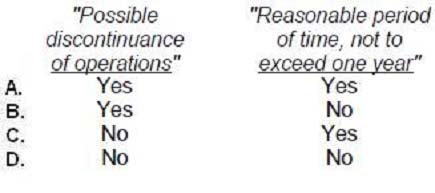

Question #28

Kane, CPA, concludes that there is substantial doubt about Lima Co.'s ability to continue as a going concern for a reasonable period of time. If Lima's financial statements adequately disclose its financial difficulties, Kane's auditor's report is required to include an explanatory paragraph that specifically uses the phrase(s):

- AOption A

- BOption B

- COption C

- DOption D

Correct Answer:

D

Choice "d" is correct. If, after considering identified conditions and events and management's plans, the auditor concludes that substantial doubt about the entity's ability to continue as a going concern for a reasonable period of time remains, the audit report should include an explanatory paragraph (following the opinion paragraph) to reflect that conclusion. This conclusion should be expressed through the use of the phrase "substantial doubt about its (the entity's) ability to continue as a going concern" [or similar wording that includes the terms "substantial doubt" and "going concern"]. The "reasonable period...not to exceed one year" is inherent in the definition of going concern and is not explicitly stated in the audit report. The phrase "possible discontinuation of operations" may be included in the going concern disclosure but is not specifically required.

Choices "a", "b", and "c" are incorrect, as per the above Explanation.

D

Choice "d" is correct. If, after considering identified conditions and events and management's plans, the auditor concludes that substantial doubt about the entity's ability to continue as a going concern for a reasonable period of time remains, the audit report should include an explanatory paragraph (following the opinion paragraph) to reflect that conclusion. This conclusion should be expressed through the use of the phrase "substantial doubt about its (the entity's) ability to continue as a going concern" [or similar wording that includes the terms "substantial doubt" and "going concern"]. The "reasonable period...not to exceed one year" is inherent in the definition of going concern and is not explicitly stated in the audit report. The phrase "possible discontinuation of operations" may be included in the going concern disclosure but is not specifically required.

Choices "a", "b", and "c" are incorrect, as per the above Explanation.

send

light_mode

delete

Question #29

Mead, CPA, had substantial doubt about Tech Co.'s ability to continue as a going concern when reporting on Tech's audited financial statements for the year ended June 30, 19X4. That doubt has been removed in 19X5. What is Mead's reporting responsibility if Tech is presenting its financial statements for the year ended June 30, 19X5, on a comparative basis with those of 19X4?

- AThe explanatory paragraph included in the 19X4 auditor's report should not be repeated.

- BThe explanatory paragraph included in the 19X4 auditor's report should be repeated in its entirety.

- CA different explanatory paragraph describing Mead's reasons for the removal of doubt should be included.

- DA different explanatory paragraph describing Tech's plans for financial recovery should be included.

Correct Answer:

A

Choice "a" is correct. If substantial doubt about the entity's ability to continue as a going concern has been removed in the current period, the explanatory paragraph included in the prior period auditor's report should not be repeated, and no description of the reasons or plans for recovery need be included.

Choice "b" is incorrect. If doubt about the going concern assumption has been removed in the current period, it is not appropriate to include the explanatory paragraph from the prior year in the auditor's report for the current year.

Choice "c" is incorrect. If doubt about the going concern assumption has been removed in the current period, no explanatory paragraph is required since the situation no longer exists. The auditor does not have to explain the reason for the change.

Choice "d" is incorrect. If doubt about the going concern assumption has been removed in the current period, no explanatory paragraph is required since the situation no longer exists. The entity does not have to describe its plans for the future.

A

Choice "a" is correct. If substantial doubt about the entity's ability to continue as a going concern has been removed in the current period, the explanatory paragraph included in the prior period auditor's report should not be repeated, and no description of the reasons or plans for recovery need be included.

Choice "b" is incorrect. If doubt about the going concern assumption has been removed in the current period, it is not appropriate to include the explanatory paragraph from the prior year in the auditor's report for the current year.

Choice "c" is incorrect. If doubt about the going concern assumption has been removed in the current period, no explanatory paragraph is required since the situation no longer exists. The auditor does not have to explain the reason for the change.

Choice "d" is incorrect. If doubt about the going concern assumption has been removed in the current period, no explanatory paragraph is required since the situation no longer exists. The entity does not have to describe its plans for the future.

send

light_mode

delete

Question #30

March, CPA, is engaged by Monday Corp., a client, to audit the financial statements of Wall Corp., a company that is not March's client. Monday expects to present Wall's audited financial statements with March's auditor's report to 1st Federal Bank to obtain financing in Monday's attempt to purchase Wall. In these circumstances, March's auditor's report would usually be addressed to:

- AMonday Corp., the client that engaged March.

- BWall Corp., the entity audited by March.

- C1st Federal Bank.

- DBoth Monday Corp. and 1st Federal Bank.

Correct Answer:

A

Choice "a" is correct. The auditors should address their report to the entity that engaged them. In this case, Monday Corp. engaged the auditor to perform an acquisition audit and the report should be addressed to Monday.

Choice "b" is incorrect. Wall Corp. did not engage the auditors and thus the report should not be addressed to them.

Choices "c" and "d" are incorrect. Even though the bank will be relying on the audited financial statements in determining whether to make the loan, the bank did not directly engage the auditing firm and accordingly, the report should not be addressed to them.

A

Choice "a" is correct. The auditors should address their report to the entity that engaged them. In this case, Monday Corp. engaged the auditor to perform an acquisition audit and the report should be addressed to Monday.

Choice "b" is incorrect. Wall Corp. did not engage the auditors and thus the report should not be addressed to them.

Choices "c" and "d" are incorrect. Even though the bank will be relying on the audited financial statements in determining whether to make the loan, the bank did not directly engage the auditing firm and accordingly, the report should not be addressed to them.

send

light_mode

delete

All Pages