Microsoft MB-310 Exam Practice Questions (P. 2)

- Full Access (410 questions)

- One Year of Premium Access

- Access to one million comments

- Seamless ChatGPT Integration

- Ability to download PDF files

- Anki Flashcard files for revision

- No Captcha & No AdSense

- Advanced Exam Configuration

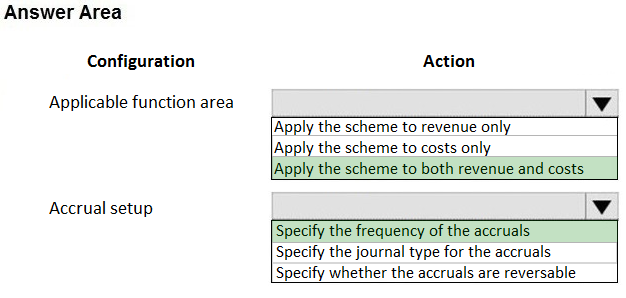

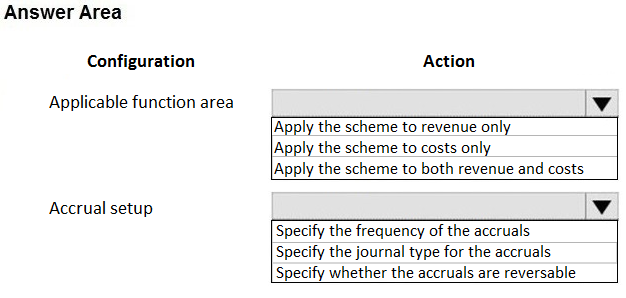

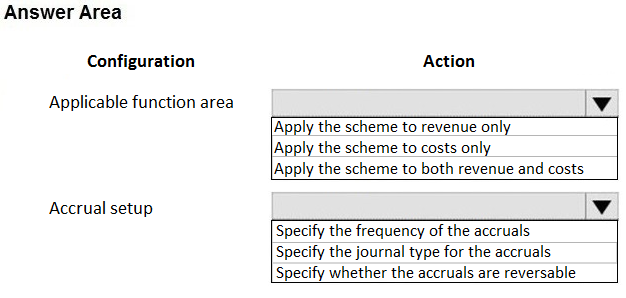

Question #11

HOTSPOT -

A rental service company hires you to configure their system to implement accrual schemes.

You need to configure the accrual schemes for the company for both rentals and associated expenses.

Which configuration and transaction options should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

A rental service company hires you to configure their system to implement accrual schemes.

You need to configure the accrual schemes for the company for both rentals and associated expenses.

Which configuration and transaction options should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

send

light_mode

delete

Question #12

A company provides employee life insurance to all full-time employees. Employee life insurance policies are paid twice a year to the insurance company.

Transactions for current employees must be recognized in the general ledger twice a month with an employee's pay. Transactions for new employees must be recognized in the general ledger based upon the employee's first pay date.

You need to configure accrual schemes for the new fiscal year.

Which two configurations should you use? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

Transactions for current employees must be recognized in the general ledger twice a month with an employee's pay. Transactions for new employees must be recognized in the general ledger based upon the employee's first pay date.

You need to configure accrual schemes for the new fiscal year.

Which two configurations should you use? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- AFor new employees, use a Credit accrual scheme. In the ledger accrual, set the offset to the first day of the fiscal year.

- BFor current employees, use a Credit accrual scheme. In the ledger accrual, set the offset to the employee's first pay date.

- CFor new employees, use a Debit accrual scheme. In the ledger accrual, set the offset to the employee's first pay date.Most Voted

- DFor current employees, use a Debit accrual scheme. In the ledger accrual, set the offset to the first day of the fiscal year.Most Voted

Correct Answer:

CD

?️

GPT-4o - Answer

GPT-4o - Answer

The correct configurations for handling the accrual of employee life insurance policies in Microsoft Dynamics 365 involve understanding the distinction between current and new employees. For current employees, we use a Debit accrual scheme where the accrual starts at the first day of the fiscal year. This setup ensures that financial obligations related to insurance are recognized promptly at the beginning of the year. On the other hand, for new employees, the recognition of these financial obligations is tied to their first pay date, aligning with their entry into the company's payroll system. This method maintains accounting accuracy and mirrors the cash flow related to employee benefits accurately in the general ledger.

send

light_mode

delete

Question #13

HOTSPOT -

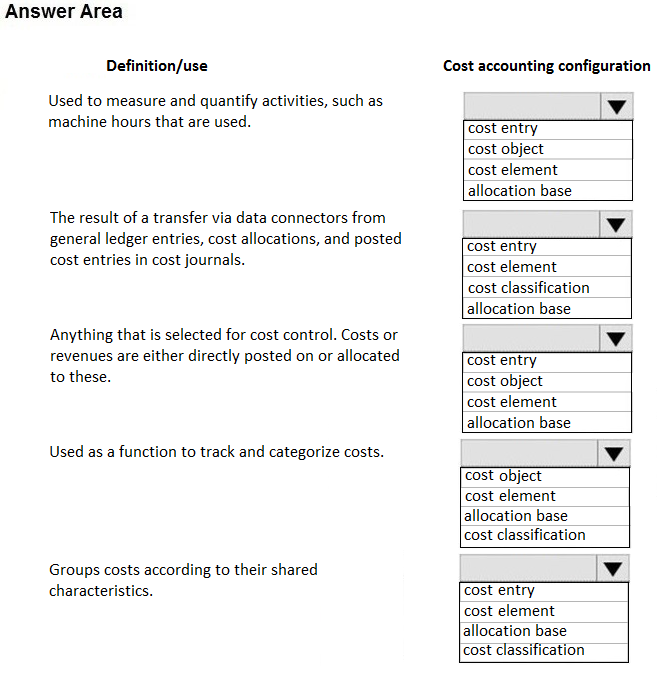

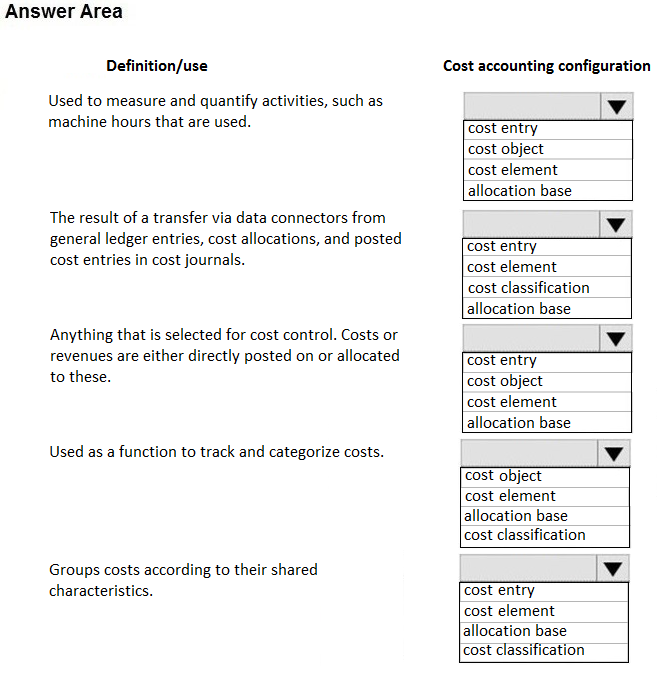

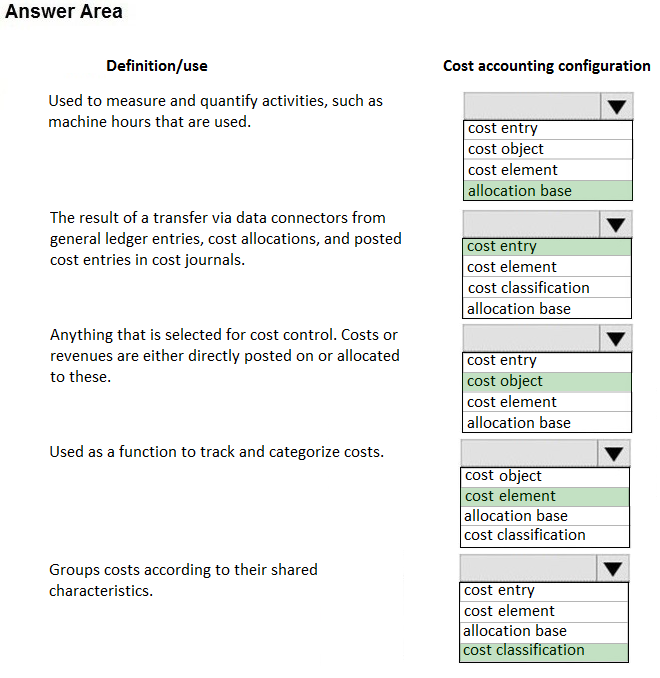

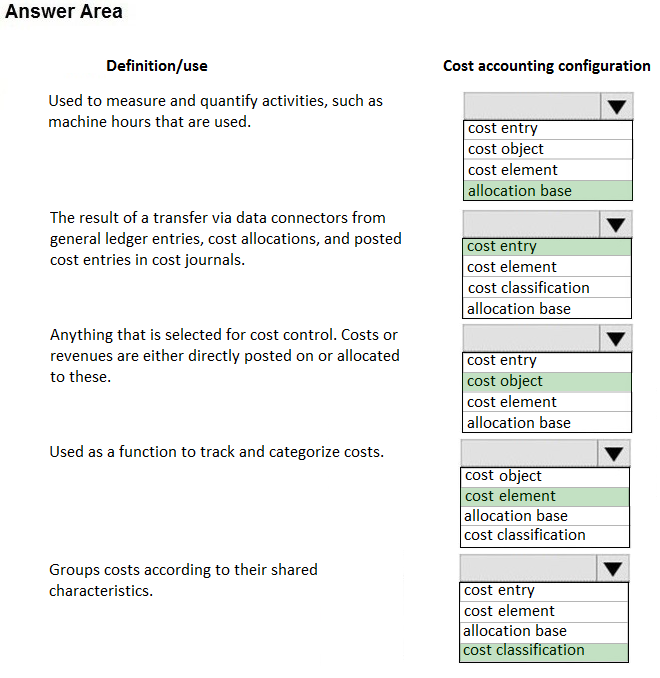

A client plans to use the cost accounting module in Dynamics 365 Finance.

You need to associate the correct definitions to the correct cost accounting concepts.

Which terms match the definitions? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

A client plans to use the cost accounting module in Dynamics 365 Finance.

You need to associate the correct definitions to the correct cost accounting concepts.

Which terms match the definitions? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

Correct Answer:

Reference:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/cost-accounting/terms-cost-accounting

Reference:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/cost-accounting/terms-cost-accounting

send

light_mode

delete

Question #14

An organization uses Dynamics 365 Finance.

Several posted journal entries contain invalid main account and dimension combinations. This leads to incorrect financial reporting.

You need to prevent these invalid combinations.

What should you do?

Several posted journal entries contain invalid main account and dimension combinations. This leads to incorrect financial reporting.

You need to prevent these invalid combinations.

What should you do?

- AConfigure the account structure to specify which financial dimensions are valid for which main accounts.

- BTrain users to select the Validate button in the current journal configuration so that the correct account and dimension combination is used.

- CConfigure financial dimension sets to limit which financial dimensions are valid for which main accounts.

- DAssociate the correct main accounts to that financial dimension on the financial dimension setup form.

Correct Answer:

A

References:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/general-ledger/configure-account-structures

A

References:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/general-ledger/configure-account-structures

send

light_mode

delete

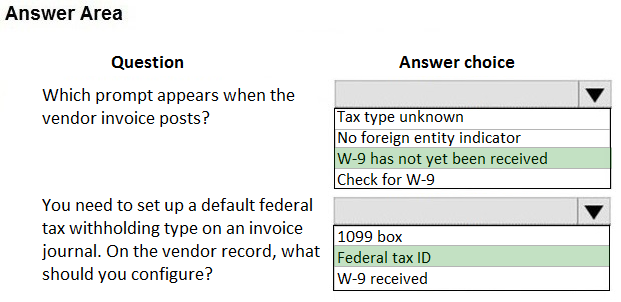

Question #15

HOTSPOT -

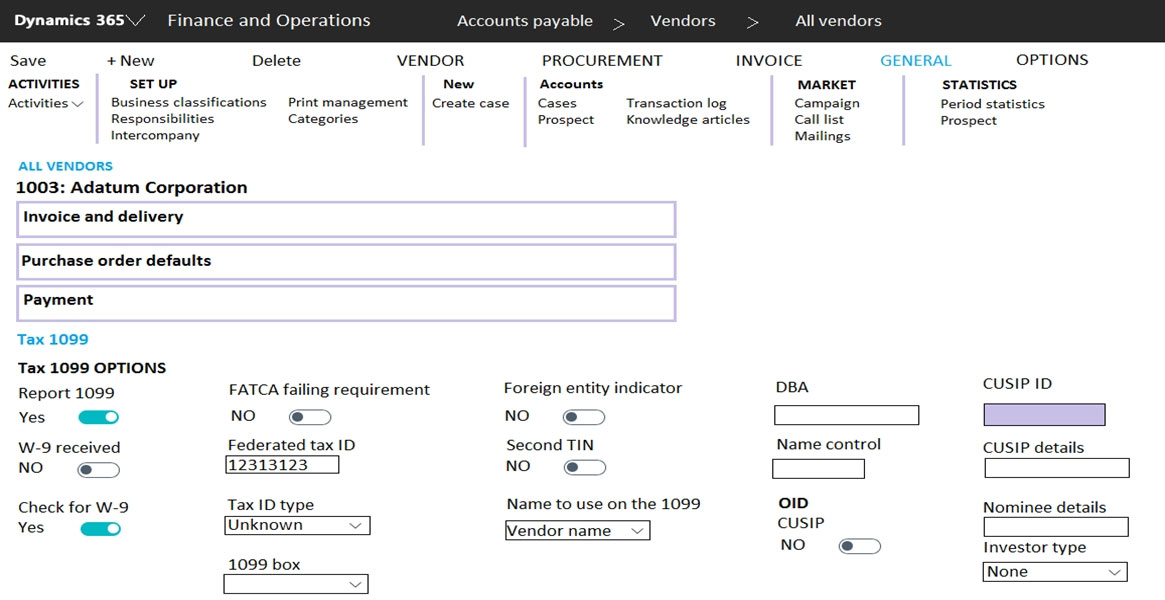

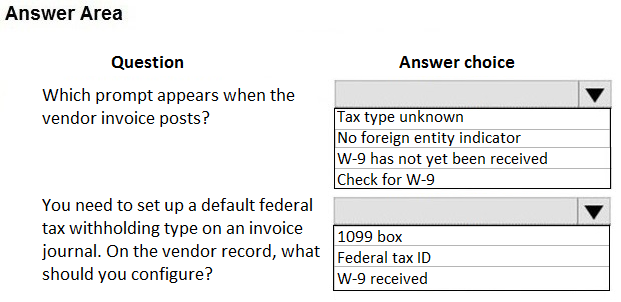

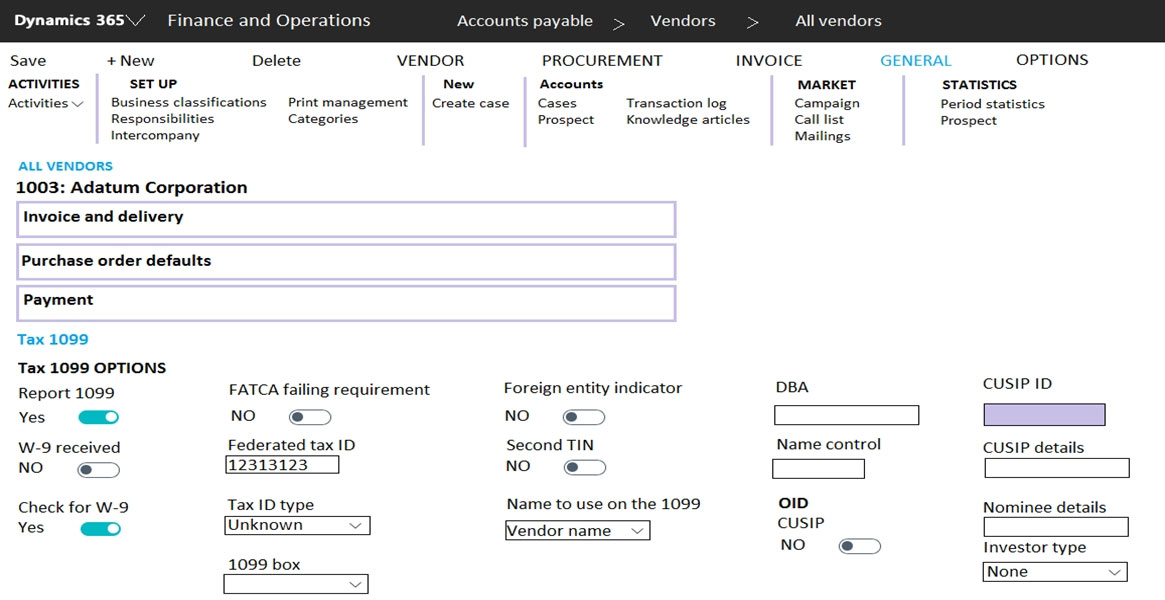

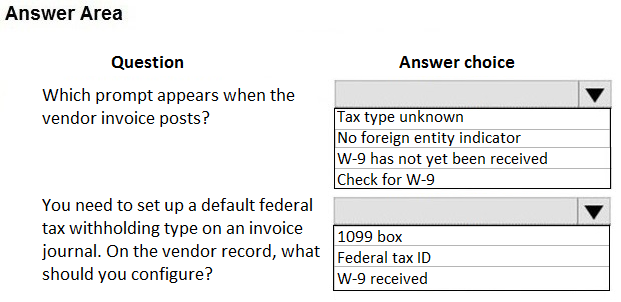

A client plans to use Dynamics 365 Finance for year-end 1099 reporting in the United States.

You are viewing a vendor master data record on the 1099 FastTab.

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

Hot Area:

A client plans to use Dynamics 365 Finance for year-end 1099 reporting in the United States.

You are viewing a vendor master data record on the 1099 FastTab.

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

Hot Area:

send

light_mode

delete

Question #16

A legal entity has locations and customers in multiple states within the United States.

You need to ensure that taxable customers are charged sales tax for taxable items in their delivery location.

Which three settings must you configure? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

You need to ensure that taxable customers are charged sales tax for taxable items in their delivery location.

Which three settings must you configure? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- Athe Sales tax group on the Customer recordMost Voted

- Bthe Terms of delivery setup

- Cthe Item Sales tax group on the Item recordMost Voted

- Dthe Sales reporting codes

- Ethe Sales tax codesMost Voted

Correct Answer:

ACE

?️

GPT-4o - Answer

GPT-4o - Answer

Users 1 and 4 accurately delineate why item sales tax groups are significant, explaining their role in tax applicability per item. However, integrating the correct approach requires understanding 'Terms of delivery setup' (B) as verified through test - it's the linchpin that ties delivery addresses to specific tax conditions despite a set sales tax group on an item. Thus, configuring the 'Sales tax group on the Customer record' (A), 'Terms of delivery setup' (B), and 'Sales tax codes' (E) ensures a seamless application of appropriate sales taxes based on delivery locations in relation to customer and item tax groups. This fulfills the Dynamics 365 setup requirements for taxation across different jurisdictions effectively.

send

light_mode

delete

Question #17

You are configuring Dynamics 365 Finance.

You need to implement posting definitions for all available transaction types.

For which type of transactions can you implement posting definitions?

You need to implement posting definitions for all available transaction types.

For which type of transactions can you implement posting definitions?

- AAccounts payable, Accounts receivable, Bank, Budget, Payroll, and PurchasingMost Voted

- BAccounts payable, Bank, Budget, Fixed assets, and Payroll

- CAccounts payable, Accounts receivable, Fixed assets, Payroll, and Purchasing

- DAccounts payable, Accounts receivable, Budget, and Fixed assets

Correct Answer:

A

A

GPT-4o - Answer

GPT-4o - Answer

Absolutely! When you're diving into posting definitions in Dynamics 365 Finance, stick to the modules like Accounts Payable, Accounts Receivable, Bank, Budget, Payroll, and Purchasing. These are your go-tos. Just remember, if you're looking for Fixed Assets, it's not in the mix for setting up posting definitions. So, rule out options that mention Fixed Assets when configuring. Keep it simple, follow this guide, and you're golden!

send

light_mode

delete

Question #18

DRAG DROP -

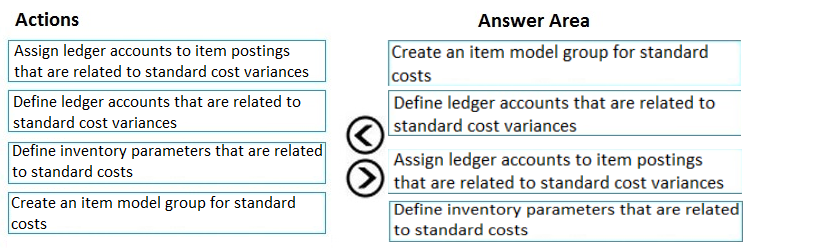

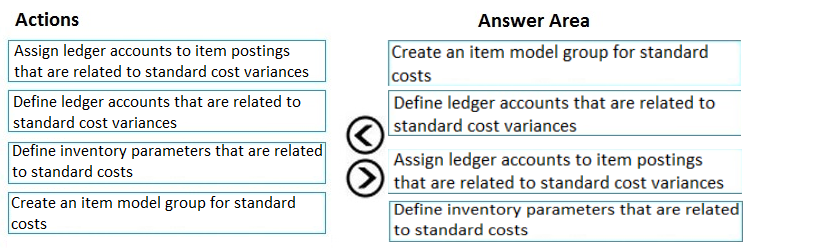

You need to set up a process of tracking, recording, and analyzing costs associated with the products or activities of a nonmanufacturing organization.

You need to configure the prerequisite setup for the standard costing version for the current period.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

Select and Place:

You need to set up a process of tracking, recording, and analyzing costs associated with the products or activities of a nonmanufacturing organization.

You need to configure the prerequisite setup for the standard costing version for the current period.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

Select and Place:

Correct Answer:

Reference:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/supply-chain/cost-management/prerequisites-standard-costs

Reference:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/supply-chain/cost-management/prerequisites-standard-costs

send

light_mode

delete

Question #19

A public sector company is configuring encumbrance for managing capital budgets.

The finance department needs to configure posting definitions for bank transactions.

You need to configure Dynamics 365 Finance for cash settlements.

What should you do?

The finance department needs to configure posting definitions for bank transactions.

You need to configure Dynamics 365 Finance for cash settlements.

What should you do?

- AConfigure combined deposit amounts

- BConfigure budget appropriations

- CConfigure general ledger year-end close

- DConfigure advanced ledger entries

Correct Answer:

A

A

GPT-4o - Answer

GPT-4o - Answer

In a public sector environment under Dynamics 365 Finance, configuring combined deposit amounts is essential for managing cash settlements effectively. Essentially, this involves amounts from individual funds pooled into a single ledger account, enhancing control over assets and promoting efficient fund management. Correctly setting this up ensures each participating fund reports proportional amounts of pooled cash and investment balances accurately, crucial for transparent and compliant financial operations.

send

light_mode

delete

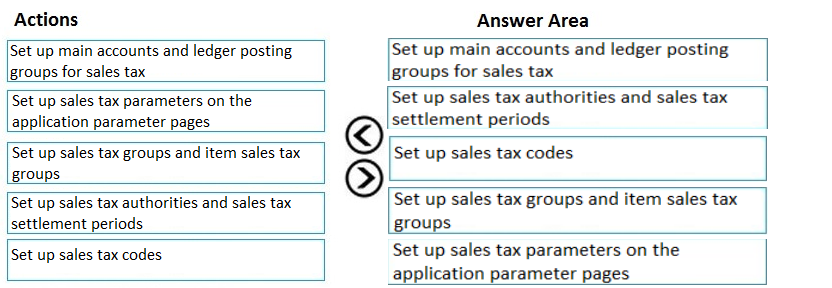

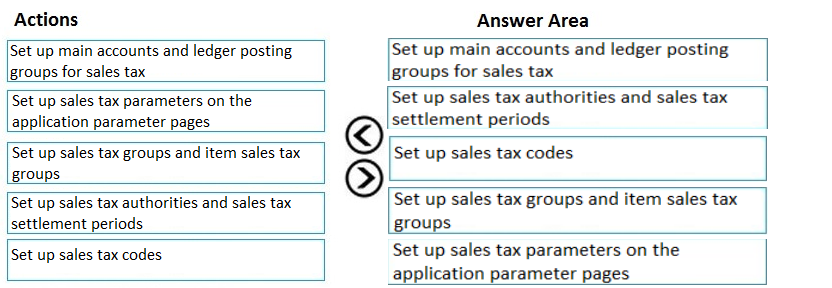

Question #20

DRAG DROP -

A retail company has outlets in multiple locations. Taxes vary depending on the location.

You need to configure the various components of the tax framework.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

Select and Place:

A retail company has outlets in multiple locations. Taxes vary depending on the location.

You need to configure the various components of the tax framework.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

Select and Place:

Correct Answer:

References:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/general-ledger/indirect-taxes-overview

References:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/general-ledger/indirect-taxes-overview

send

light_mode

delete

All Pages