AIWMI CCRA Exam Practice Questions (P. 4)

- Full Access (84 questions)

- One Year of Premium Access

- Access to one million comments

- Seamless ChatGPT Integration

- Ability to download PDF files

- Anki Flashcard files for revision

- No Captcha & No AdSense

- Advanced Exam Configuration

Question #16

Ms. Mary Brown is a credit rating analyst. She had prepared a detailed report on one of her client, FlyHigh Airlines Ltd, a company operating chartered aircrafts in

India. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could recollect few numbers from her memory and reconstructed following partial financial table:

An analyst comparing two competitors Comp Systems and Big Tables gathers the data below:

Cash Conversions Cycle:

Comp Systems: 18 days and Big Tables 32 days

Defense Interval Ratio:

Comp Systems: 50 and Big Tables: 20

What can the analyst conclude regarding the liquidity of these companies?

India. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could recollect few numbers from her memory and reconstructed following partial financial table:

An analyst comparing two competitors Comp Systems and Big Tables gathers the data below:

Cash Conversions Cycle:

Comp Systems: 18 days and Big Tables 32 days

Defense Interval Ratio:

Comp Systems: 50 and Big Tables: 20

What can the analyst conclude regarding the liquidity of these companies?

- ABoth indicators suggest that Comp Systems is more liquid than Big Tables

- BBoth indicators suggest that Big Tables manages it/s cash better than Comp Systems

- CBoth indicators give contradictory results

- DWhile Comp Systems is more liquid as per the Cash conversion cycle, Big Tables manages its cash better as indicated by a lower, hence better Defense Ratio

Correct Answer:

C

C

send

light_mode

delete

Question #17

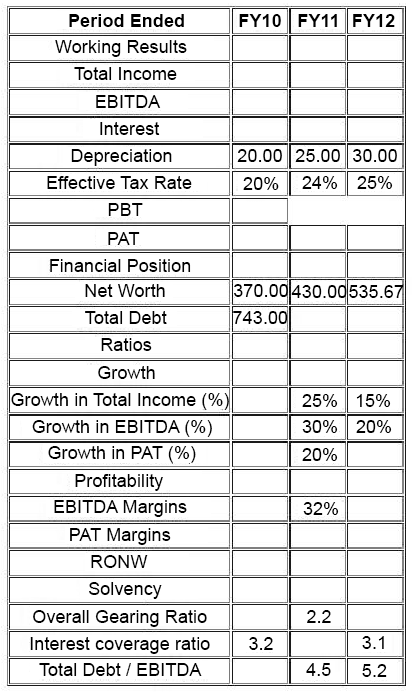

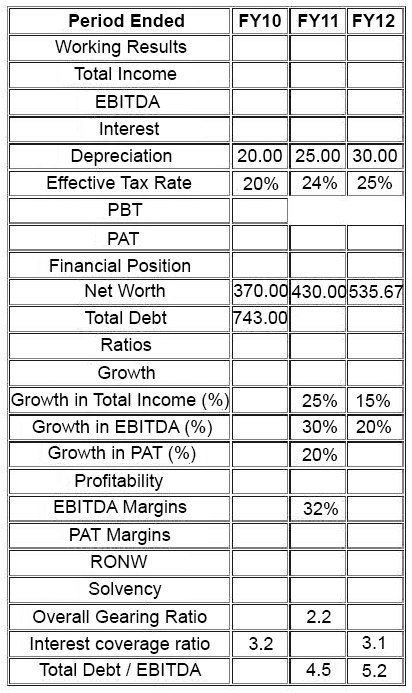

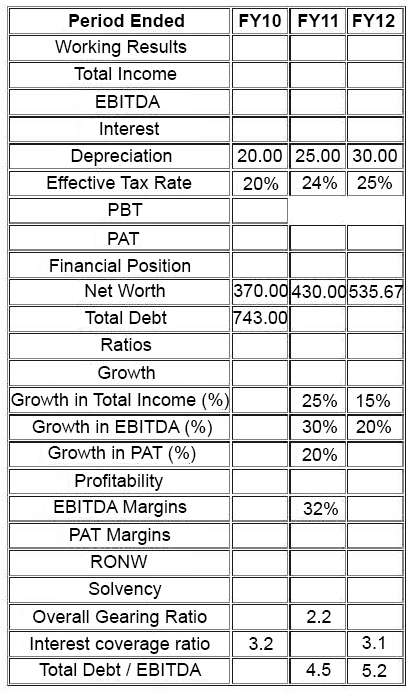

Ms. Mary Brown is a credit rating analyst. She had prepared a detailed report on one of her client, FlyHigh Airlines Ltd, a company operating chartered aircrafts in

India. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could recollect few numbers from her memory and reconstructed following partial financial table:

What is Total Income FY10 and FY12?

India. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could recollect few numbers from her memory and reconstructed following partial financial table:

What is Total Income FY10 and FY12?

- AFY10: INR400 Million; FY12:INR575 Million

- BFY10: INR525.56 Million; FY12: INR755.49 Million

- CInsufficient Information to compute

- DFY10: INR656.94 Million; FY12: INR821.18 Million

Correct Answer:

A

A

send

light_mode

delete

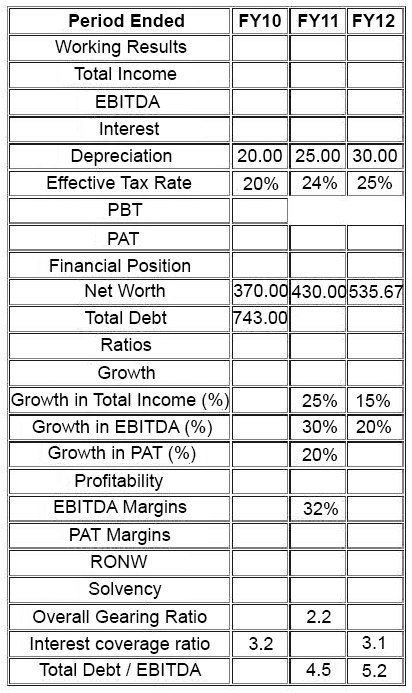

Question #18

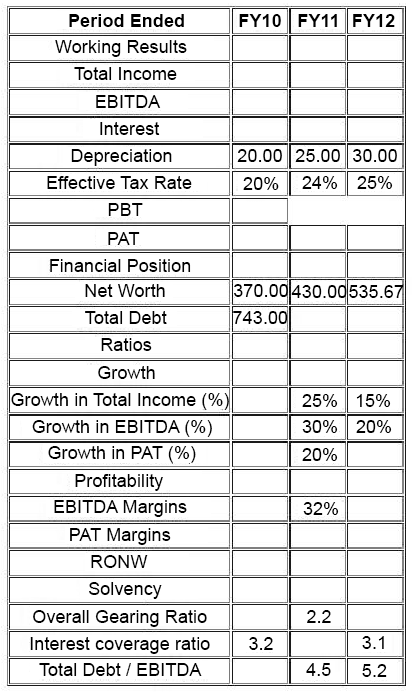

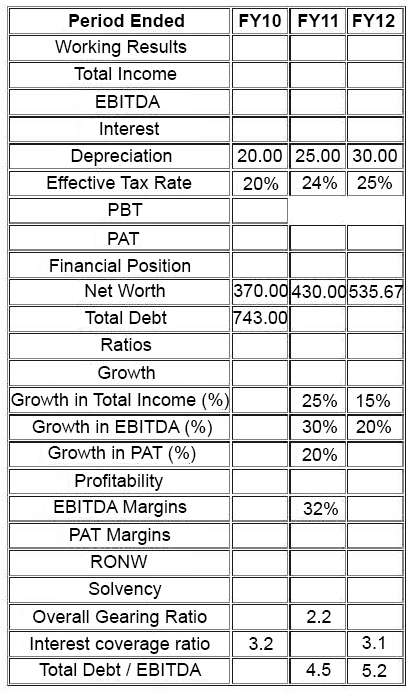

Ms. Mary Brown is a credit rating analyst. She had prepared a detailed report on one of her client, FlyHigh Airlines Ltd, a company operating chartered aircrafts in

India. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could recollect few numbers from her memory and reconstructed following partial financial table:

Compute growth in PAT for FY12?

India. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could recollect few numbers from her memory and reconstructed following partial financial table:

Compute growth in PAT for FY12?

send

light_mode

delete

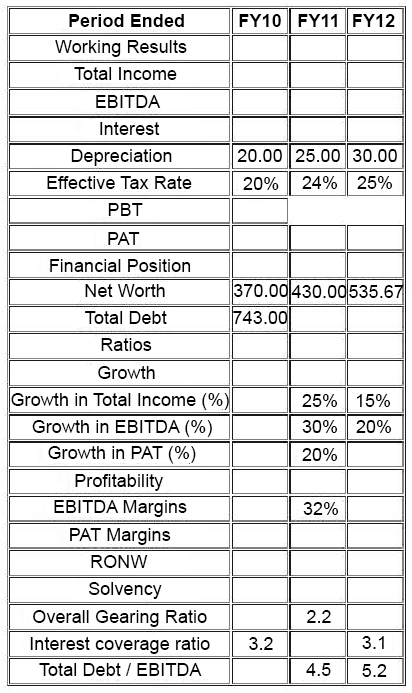

Question #19

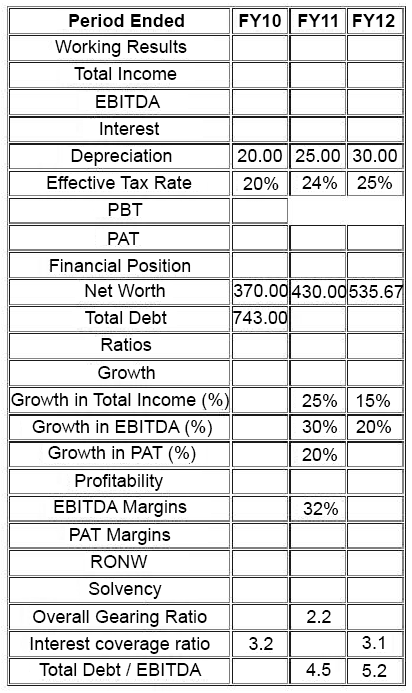

Ms. Mary Brown is a credit rating analyst. She had prepared a detailed report on one of her client, FlyHigh Airlines Ltd, a company operating chartered aircrafts in

India. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could recollect few numbers from her memory and reconstructed following partial financial table:

PAT margins are highest in which of the years?

India. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could recollect few numbers from her memory and reconstructed following partial financial table:

PAT margins are highest in which of the years?

send

light_mode

delete

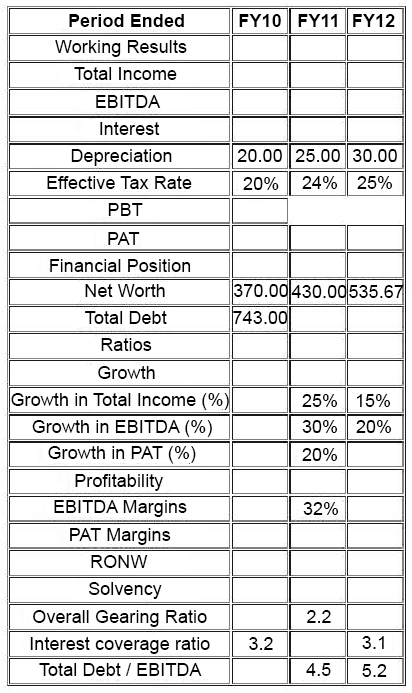

Question #20

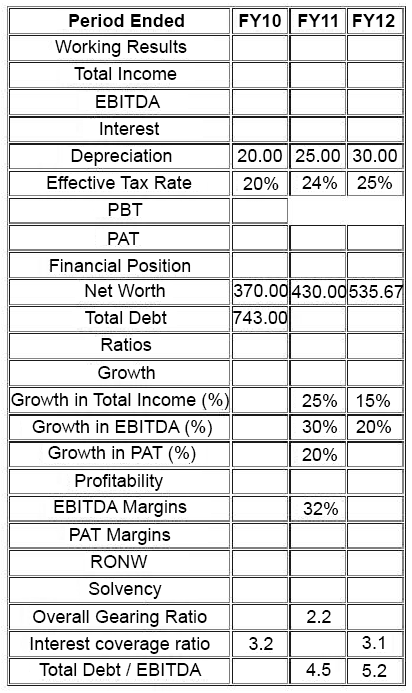

Ms. Mary Brown is a credit rating analyst. She had prepared a detailed report on one of her client, FlyHigh Airlines Ltd, a company operating chartered aircrafts in

India. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could recollect few numbers from her memory and reconstructed following partial financial table:

Compute Interest for FY10 and FY12?

India. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could recollect few numbers from her memory and reconstructed following partial financial table:

Compute Interest for FY10 and FY12?

- AInsufficient Information to compute

- BFY10: INR50.53 Million; FY12:INR81.38 Million

- CFY10: INR161.71 Million; FY12: INR252.27 Million

- DFY10: INR17.47 Million; FY12:INR782.03 Million

Correct Answer:

C

C

send

light_mode

delete

All Pages