AIWMI CCRA Exam Practice Questions (P. 2)

- Full Access (84 questions)

- One Year of Premium Access

- Access to one million comments

- Seamless ChatGPT Integration

- Ability to download PDF files

- Anki Flashcard files for revision

- No Captcha & No AdSense

- Advanced Exam Configuration

Question #6

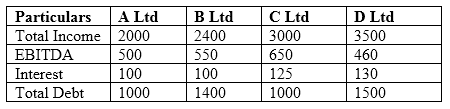

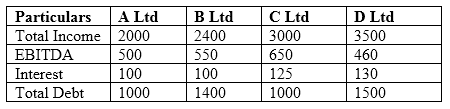

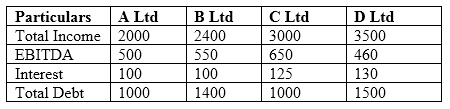

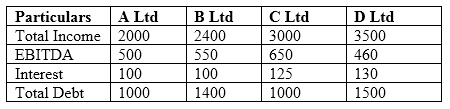

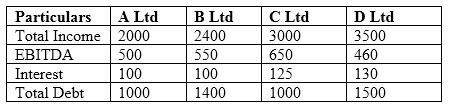

Scott is a credit analyst with one of the credit rating agencies in India. He was looking in Oil and Gas Industry companies and has presented brief financials for following 4 entities:

Which of the four entities has best interest coverage ratios?

Which of the four entities has best interest coverage ratios?

send

light_mode

delete

Question #7

Scott is a credit analyst with one of the credit rating agencies in India. He was looking in Oil and Gas Industry companies and has presented brief financials for following 4 entities:

Two credit analysts are discussing the DM-approach to credit risk modeling. They make the following statements:

Analyst A: A portfolio's standard deviation of credit losses can be determined by considering the standard deviation of credit losses of individual exposures in the portfolio and summing them all up.

Analyst B: I do not fully agree with that. Apart from individual standard deviations, one also needs to consider the correlation of the exposure with the rest of the portfolio so as to account for diversification effects. Higher correlations among credit exposures will lead to higher standard deviation of the overall portfolio.

Two credit analysts are discussing the DM-approach to credit risk modeling. They make the following statements:

Analyst A: A portfolio's standard deviation of credit losses can be determined by considering the standard deviation of credit losses of individual exposures in the portfolio and summing them all up.

Analyst B: I do not fully agree with that. Apart from individual standard deviations, one also needs to consider the correlation of the exposure with the rest of the portfolio so as to account for diversification effects. Higher correlations among credit exposures will lead to higher standard deviation of the overall portfolio.

- AOnly Analyst A is correct

- BBoth are correct

- COnly Analyst B is correct

- DBoth are incorrect

Correct Answer:

C

C

send

light_mode

delete

Question #8

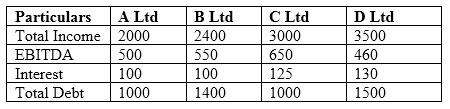

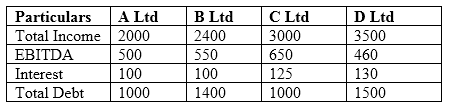

Scott is a credit analyst with one of the credit rating agencies in India. He was looking in Oil and Gas Industry companies and has presented brief financials for following 4 entities:

Giving equal weightage to all three ratios, determine which of the above entities should be rated highest on a relative scale.

Giving equal weightage to all three ratios, determine which of the above entities should be rated highest on a relative scale.

send

light_mode

delete

Question #9

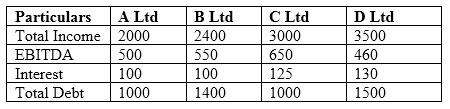

Scott is a credit analyst with one of the credit rating agencies in India. He was looking in Oil and Gas Industry companies and has presented brief financials for following 4 entities:

From the data given below, calculate the standard deviation of the credit portfolio assuming that facility's exposure is known with certainty, customer defaults and

LGDs are independent of one another and LGDs are independent across borrower(s).

Credit Facility A "" Loss Equivalent Exposure of $60m, expected Default frequency of 1.5%, loss given default of 30%, Std Deviation of LGD "" 5% and Correlation to portfolio "" 0.10

Credit Facility B "" Loss Equivalent Exposure of $25m, expected Default frequency of 2%, loss given default of 12%, Std Deviation of LGD "" 12% and Correlation to portfolio "" 0.45

Credit Facility C "" Loss Equivalent Exposure of $15m, expected Default frequency of 5%, loss given default of 85%, Std Deviation of LGD "" 18% and Correlation to portfolio "" 0.22

From the data given below, calculate the standard deviation of the credit portfolio assuming that facility's exposure is known with certainty, customer defaults and

LGDs are independent of one another and LGDs are independent across borrower(s).

Credit Facility A "" Loss Equivalent Exposure of $60m, expected Default frequency of 1.5%, loss given default of 30%, Std Deviation of LGD "" 5% and Correlation to portfolio "" 0.10

Credit Facility B "" Loss Equivalent Exposure of $25m, expected Default frequency of 2%, loss given default of 12%, Std Deviation of LGD "" 12% and Correlation to portfolio "" 0.45

Credit Facility C "" Loss Equivalent Exposure of $15m, expected Default frequency of 5%, loss given default of 85%, Std Deviation of LGD "" 18% and Correlation to portfolio "" 0.22

- AUS$6.88 million

- BUS$ 1.16 million

- CUS$ 1.66 million

- DUS$ 0.10 million

Correct Answer:

B

B

send

light_mode

delete

Question #10

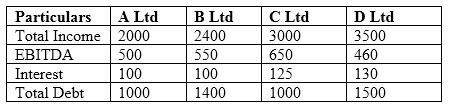

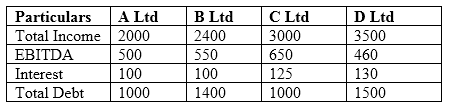

Scott is a credit analyst with one of the credit rating agencies in India. He was looking in Oil and Gas Industry companies and has presented brief financials for following 4 entities:

Which of the following statements is incorrect?

Which of the following statements is incorrect?

- AB Ltd has higher EBITDA margins as compared to C Ltd.

- BD Ltd has higher EBITDA margins as competed to B Ltd.

- CC Ltd has worst total debt to EBITDA ratio.

- DB Ltd has worst interest coverage ratio.

Correct Answer:

A

A

send

light_mode

delete

All Pages