ABA CRCM Exam Practice Questions (P. 1)

- Full Access (462 questions)

- One Year of Premium Access

- Access to one million comments

- Seamless ChatGPT Integration

- Ability to download PDF files

- Anki Flashcard files for revision

- No Captcha & No AdSense

- Advanced Exam Configuration

Question #1

To be effective, compliance risk management professionals must design a framework to ensure that bank management understands the risks and the steps that must be taken to mitigate them. The many roles compliance professionals fill incorporate risk management aspects including:

- ACoordinating regulatory exams to explain risks to examiners

- BOverseeing compliance training targeting higher risk areas

- CTracking regulatory proposals and final rules to understand new risks

- DAll of theseMost Voted

Correct Answer:

D

D

send

light_mode

delete

Question #2

They also embrace the concept of risk-based compliance management. They expect compliance management to be tailored to the bank, be it large or small, offering standard or specialty financial services, simple or complex products lines, and adjusted as appropriate for the customer base as that issued for the Bank

Secrecy Act, also establishes their expectations that a bank's program be risk based. Who are they?

Secrecy Act, also establishes their expectations that a bank's program be risk based. Who are they?

- AOutsourcing firms

- BForeign financial service providers

- CBank regulatory agenciesMost Voted

- DRisk management organizations

Correct Answer:

C

C

send

light_mode

delete

Question #3

A compliance professional's responsibilities include all of the following EXCEPT:

- AUnderstanding the business units operating environment and risk tolerance

- BPerforming risk assessments with the assistance of business units to determine current risk levels and risks associated with the bank's products, lines of business, customers, and locations, among other factors

- CWorking with business units to ensure prompt corrective action for any detected errors

- DAssisting business lines with compliance training for employees, as neededMost Voted

Correct Answer:

D

D

send

light_mode

delete

Question #4

______________ should include basic elements designed to understand and mitigate risk. It usually includes:

Written program -

Compliance-related policies and procedures

Written program -

Compliance-related policies and procedures

- ATactical Compliance procedure

- BRank solution

- CCompliance programMost Voted

- DNone of these

Correct Answer:

C

C

send

light_mode

delete

Question #5

In a compliance program, tactical compliance procedures should be integrated into business line procedures, such as how to deliver an Adverse Action Notice when an application is declined. In this case:

- ARegulations should be applied consistently to procedures throughout the bankMost Voted

- BRevisions to procedures should be based on compliance expertise and not mere editingMost Voted

- CProviding solutions to mitigate any identified risk

- DAssisting business units in developing or revising policies and procedures to reflect current regulatory requirements

Correct Answer:

AB

AB

send

light_mode

delete

Question #6

Which of the following should be done during research and interpreting regulations Compliance professionals in mitigating compliance risk?

- ATrack regulatory proposalsMost Voted

- BImplementing final regulatory rulesMost Voted

- CUnderstanding the business units' operating environment and risk tolerance

- DRanking solutions as high, moderate and low riskMost Voted

Correct Answer:

ABD

ABD

send

light_mode

delete

Question #7

The compliance program should address plans to verify adherence to applicable regulations through:

- AOngoing monitoring to evaluate the program, self monitoring and corrective actionMost Voted

- BSelf monitoring

- CPeriodic reviews

- DOngoing monitoring to evaluate the program, self monitoring and periodic reviews

Correct Answer:

A

A

send

light_mode

delete

Question #8

There is no established template for documenting compliance risk. Each institution should develop a risk assessment that fits its risk profile. The components that are commonly used throughout the industry are as follows EXCEPT:

- ARisk assessment

- BMeasuring key risk indicators

- CIdentifying key performance indicators

- DTraining the leadership of compliance regulation programMost Voted

Correct Answer:

D

D

send

light_mode

delete

Question #9

In Compliance regulation and risk assessment key performance indicators usually include:

- AFines or penaltiesMost Voted

- BCustomer complaintsMost Voted

- CRegulatory criticism from a regulator or internal or external auditorsMost Voted

- DNone of these

Correct Answer:

ABC

ABC

send

light_mode

delete

Question #10

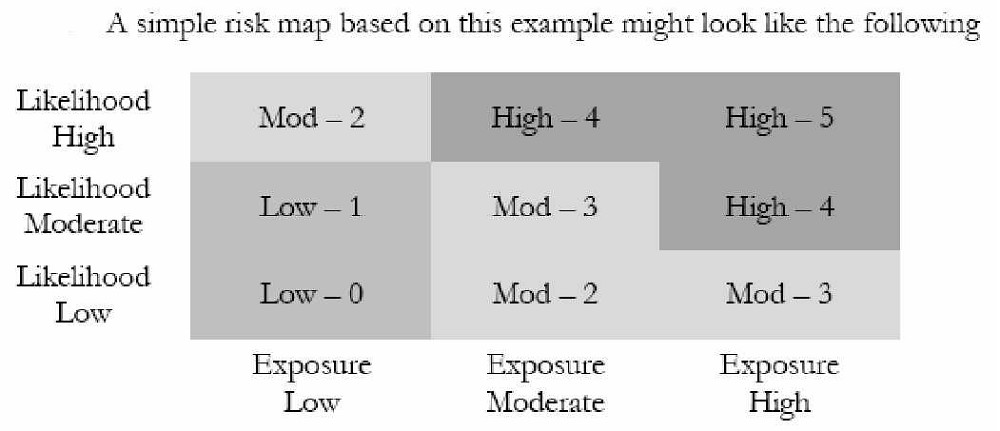

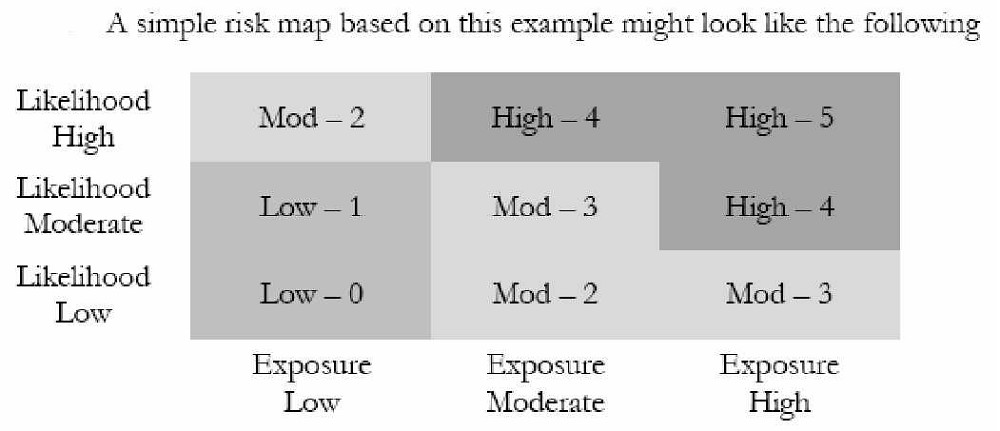

For example on a 0-5 scale:

The risk trend shows the direction of risk and probable change to risk over the next 12 months. A trend toward increasing risk means that

The risk trend shows the direction of risk and probable change to risk over the next 12 months. A trend toward increasing risk means that

- AManagement may want to take additional action through more controls or increased reviewsMost Voted

- BRisk may prompt a decrease in controls and improved efficiencies

- CControls currently in place are appropriate to succeed in keeping risks within management's established risk-tolerance level

- DRisk measurements exceed management's tolerance for risk

Correct Answer:

A

A

send

light_mode

delete

All Pages