Oracle 1z0-1055-21 Exam Practice Questions (P. 4)

- Full Access (71 questions)

- One Year of Premium Access

- Access to one million comments

- Seamless ChatGPT Integration

- Ability to download PDF files

- Anki Flashcard files for revision

- No Captcha & No AdSense

- Advanced Exam Configuration

Question #16

In which two ways does the invoice imaging solution work in the cloud? (Choose two.)

- ACustomers ask suppliers to send electronic invoices.

- BCustomers ask their suppliers to scan and email the invoice.

- CCustomers scan and store the invoice images on-premise and attach them during invoice entry.

- DCustomers scan the invoice on-premise and email the images.

- ECustomers cannot use invoice imaging in the Cloud.

Correct Answer:

BD

BD

send

light_mode

delete

Question #17

Which two invoice types can have a status of Incomplete? (Choose two.)

- ASupplier Portal Invoices which are rejected and resubmitted for approval

- BScanned Invoices with incomplete or missing informationMost Voted

- CScanned Invoices which are rejected during importMost Voted

- DPrepayment Invoices which are fully paid but not applied against any invoice

- ESupplier Portal Invoices which are saved but not yet submitted

Correct Answer:

AB

AB

send

light_mode

delete

Question #18

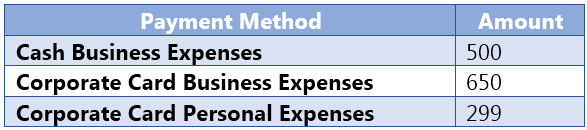

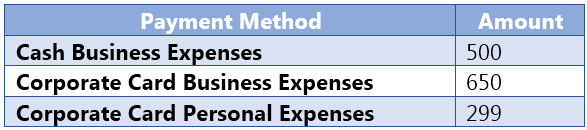

You use corporate cards with expenses and have implemented the Company Pay payment option. An employee incurred the following expenses.

What is the resulting payment amount made to the employee for these expenses?

What is the resulting payment amount made to the employee for these expenses?

send

light_mode

delete

Question #19

You have successfully processed the expense reports for reimbursement and have transferred the information to Payables.

What is the next step before you can pay them?

What is the next step before you can pay them?

- ACreate a payment process request in Payments.

- BCreate Accounting for the invoice in Payables.

- CValidate the invoice in Payables.

- DTransfer the data to General Ledger.

Correct Answer:

C

C

send

light_mode

delete

Question #20

Certain suppliers that your customer regularly deals with are exempt from tax.

How should you configure tax for this?

How should you configure tax for this?

- AEnable the relevant suppliers for Offset Tax and create an Offset Tax to remove the calculated tax line from these suppliers.

- BDefine a Tax Status and Rate for Exempt, define a Party Fiscal Classification of Exempt, assign it to the relevant suppliers, and write a rule to incorporate the exempt Party Fiscal Classification.

- CCreate a new Tax Regime for the Exempt tax and subscribe the exempt suppliers to the tax regime on the Configuration Options tab.

- DDefine a Tax Status and Rate for Exempt, define a Supplier Fiscal Classification of Exempt, assign it to the relevant suppliers, and write a rule to incorporate the exempt Supplier Fiscal Classification.

Correct Answer:

D

D

send

light_mode

delete

All Pages