AICPA AUD Exam Practice Questions (P. 5)

- Full Access (1022 questions)

- One Year of Premium Access

- Access to one million comments

- Seamless ChatGPT Integration

- Ability to download PDF files

- Anki Flashcard files for revision

- No Captcha & No AdSense

- Advanced Exam Configuration

Question #41

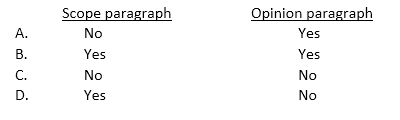

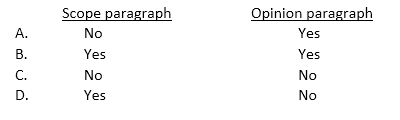

When disclaiming an opinion due to a client-imposed scope limitation, an auditor should indicate in a separate paragraph why the audit did not comply with generally accepted auditing standards. The auditor should also omit the:

- AOption A

- BOption B

- COption C

- DOption D

Correct Answer:

D

Choice "d" is correct. When disclaiming an opinion because of scope limitations, the auditor should indicate in a separate paragraph(s) the reasons that the audit did not comply with GAAS. The auditor should also omit the scope paragraph. The opinion paragraph is not omitted; however, it indicates that no opinion is expressed.

Choices "a", "b", and "c" are incorrect, as per the above Explanation.

D

Choice "d" is correct. When disclaiming an opinion because of scope limitations, the auditor should indicate in a separate paragraph(s) the reasons that the audit did not comply with GAAS. The auditor should also omit the scope paragraph. The opinion paragraph is not omitted; however, it indicates that no opinion is expressed.

Choices "a", "b", and "c" are incorrect, as per the above Explanation.

send

light_mode

delete

Question #42

An auditor decides to issue a qualified opinion on an entity's financial statements because a major inadequacy in its computerized accounting records prevents the auditor from applying necessary procedures. The opinion paragraph of the auditor's report should state that the qualification pertains to:

- AA client-imposed scope limitation.

- BA departure from generally accepted auditing standards.

- CThe possible effects on the financial statements.

- DInadequate disclosure of necessary information.

Correct Answer:

C

Choice "C" is correct. When an auditor qualifies his opinion because of a scope limitation, the wording in the opinion paragraph should indicate that the qualification pertains to the possible effects on the financial statements and not to the scope limitation itself.

Choice "A" is incorrect. When an auditor qualifies his opinion because of a scope limitation, the wording in the opinion paragraph should indicate that the qualification pertains to the possible effects on the financial statements and not to the scope limitation itself.

Choice "B" is incorrect. A scope limitation is a departure from generally accepted auditing standards. However, when an auditor qualifies his opinion because of a scope limitation, the wording in the opinion paragraph should indicate that the qualification pertains to the possible effects on the financial statements and not to the scope limitation itself.

Choice "D" is incorrect. Inadequate disclosure of necessary information is a departure from GAAP, rather than a scope limitation.

C

Choice "C" is correct. When an auditor qualifies his opinion because of a scope limitation, the wording in the opinion paragraph should indicate that the qualification pertains to the possible effects on the financial statements and not to the scope limitation itself.

Choice "A" is incorrect. When an auditor qualifies his opinion because of a scope limitation, the wording in the opinion paragraph should indicate that the qualification pertains to the possible effects on the financial statements and not to the scope limitation itself.

Choice "B" is incorrect. A scope limitation is a departure from generally accepted auditing standards. However, when an auditor qualifies his opinion because of a scope limitation, the wording in the opinion paragraph should indicate that the qualification pertains to the possible effects on the financial statements and not to the scope limitation itself.

Choice "D" is incorrect. Inadequate disclosure of necessary information is a departure from GAAP, rather than a scope limitation.

send

light_mode

delete

Question #43

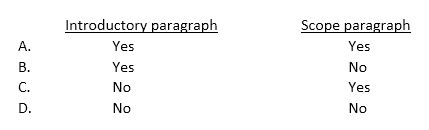

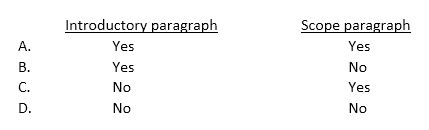

When an auditor qualifies an opinion because of inadequate disclosure, the auditor should describe the nature of the omission in a separate explanatory paragraph and modify the:

- AOption A

- BOption B

- COption C

- DOption D

Correct Answer:

D

Choice "D" is correct. In a report qualified for inadequate disclosure, the auditor would add an explanatory paragraph and modify the opinion paragraph, but the introductory and scope paragraphs would not be modified.

Choices "A", "B", and "C" are incorrect, as per the above Explanation.

D

Choice "D" is correct. In a report qualified for inadequate disclosure, the auditor would add an explanatory paragraph and modify the opinion paragraph, but the introductory and scope paragraphs would not be modified.

Choices "A", "B", and "C" are incorrect, as per the above Explanation.

send

light_mode

delete

Question #44

An entity changed from the straight-line method to the declining balance method of depreciation for all newly acquired assets. This change has no material effect on the current year's financial statements, but is reasonably certain to have a substantial effect in later years. If the change is disclosed in the notes to the financial statements, the auditor should issue a report with a(an):

- A"Except for" qualified opinion.

- BExplanatory paragraph.

- CUnqualified opinion.

- DConsistency modification.

Correct Answer:

C

Choice "C" is correct. If an accounting change has no material effect on the financial statements in the current year, but a material future effect, the auditor must ensure that the change is disclosed in the footnotes whenever the financial statements of the change period are presented, but does not have to recognize the change in the current year's audit report.

Choice "A" is incorrect. Accounting changes that are accounted for properly do not result in qualified opinions.

Choices "B" and "D" are incorrect. A consistency modification (explanatory paragraph) is not necessary when the effect of a change is immaterial.

C

Choice "C" is correct. If an accounting change has no material effect on the financial statements in the current year, but a material future effect, the auditor must ensure that the change is disclosed in the footnotes whenever the financial statements of the change period are presented, but does not have to recognize the change in the current year's audit report.

Choice "A" is incorrect. Accounting changes that are accounted for properly do not result in qualified opinions.

Choices "B" and "D" are incorrect. A consistency modification (explanatory paragraph) is not necessary when the effect of a change is immaterial.

send

light_mode

delete

Question #45

If a publicly held company issues financial statements that purport to present its financial position and results of operations but omits the statement of cash flows, the auditor ordinarily will express a(an):

- ADisclaimer of opinion.

- BQualified opinion.

- CReview report.

- DUnqualified opinion with a separate explanatory paragraph.

Correct Answer:

B

Choice "B" is correct. If a company issues financial statements that purport to present financial position and results of operations but omits the related statement of cash flows, the auditor will normally conclude that the omission requires qualification of the opinion.

Choice "A" is incorrect. If the company fails to present its statement of cash flows, this is considered inadequate disclosure. The auditor would not issue a disclaimer of opinion for inadequate disclosure.

Choice "C" is incorrect. The auditor would not issue a review report when performing an audit.

Choice "D" is incorrect. The auditor cannot issue an unqualified report if the client omits a statement of cash flows from the financial statements.

B

Choice "B" is correct. If a company issues financial statements that purport to present financial position and results of operations but omits the related statement of cash flows, the auditor will normally conclude that the omission requires qualification of the opinion.

Choice "A" is incorrect. If the company fails to present its statement of cash flows, this is considered inadequate disclosure. The auditor would not issue a disclaimer of opinion for inadequate disclosure.

Choice "C" is incorrect. The auditor would not issue a review report when performing an audit.

Choice "D" is incorrect. The auditor cannot issue an unqualified report if the client omits a statement of cash flows from the financial statements.

send

light_mode

delete

Question #46

In which of the following circumstances would an auditor most likely add an explanatory paragraph to the standard report while not affecting the auditor's unqualified opinion?

- AThe auditor is asked to report on the balance sheet, but not on the other basic financial statements.

- BThere is substantial doubt about the entity's ability to continue as a going concern.

- CManagement's estimates of the effects of future events are unreasonable.

- DCertain transactions cannot be tested because of management's records retention policy.

Correct Answer:

B

Choice "B" is correct. If, after considering identified conditions and events and management's plans, the auditor concludes that substantial doubt about the entity's ability to continue as a going concern for a reasonable period of time remains, the audit report should include an explanatory paragraph to reflect that conclusion.

Choice "A" is incorrect. Reporting on just the balance sheet is acceptable provided access to financial information is not limited. Such reporting does not require an explanatory paragraph.

Choice "C" is incorrect. If the auditor concludes that management's estimate is unreasonable and that its effect is to cause the financial statements to be materially misstated, the auditor should express a qualified or an adverse opinion.

Choice "D" is incorrect. Restrictions on the scope of the audit, whether imposed by the client or by circumstances, may require the auditor to qualify or to disclaim an opinion.

B

Choice "B" is correct. If, after considering identified conditions and events and management's plans, the auditor concludes that substantial doubt about the entity's ability to continue as a going concern for a reasonable period of time remains, the audit report should include an explanatory paragraph to reflect that conclusion.

Choice "A" is incorrect. Reporting on just the balance sheet is acceptable provided access to financial information is not limited. Such reporting does not require an explanatory paragraph.

Choice "C" is incorrect. If the auditor concludes that management's estimate is unreasonable and that its effect is to cause the financial statements to be materially misstated, the auditor should express a qualified or an adverse opinion.

Choice "D" is incorrect. Restrictions on the scope of the audit, whether imposed by the client or by circumstances, may require the auditor to qualify or to disclaim an opinion.

send

light_mode

delete

Question #47

When an entity changes its method of accounting for income taxes, which has a material effect on comparability, the auditor should refer to the change in an explanatory paragraph added to the auditor's report. This paragraph should identify the nature of the change and:

- AExplain why the change is justified under generally accepted accounting principles.

- BDescribe the cumulative effect of the change on the audited financial statements.

- CState the auditor's explicit concurrence with or opposition to the change.

- DRefer to the financial statement note that discusses the change in detail.

Correct Answer:

D

Choice "D" is correct. The paragraph should refer to the note in the financial statements that discusses the change in detail. Following is an example of an appropriate explanatory paragraph: "As discussed in Note X to the financial statements, the company changed its method of accounting for income taxes in X2."

Choice "A" is incorrect. The auditor need not explain why a change from one generally accepted accounting principle to another is justified.

Choice "B" is incorrect. The paragraph should not identify the cumulative effect of the change on the audited financial statements.

Choice "C" is incorrect. The auditor should never explicitly state concurrence with a change. If the auditor opposes the change, a qualified or adverse opinion should be issued.

D

Choice "D" is correct. The paragraph should refer to the note in the financial statements that discusses the change in detail. Following is an example of an appropriate explanatory paragraph: "As discussed in Note X to the financial statements, the company changed its method of accounting for income taxes in X2."

Choice "A" is incorrect. The auditor need not explain why a change from one generally accepted accounting principle to another is justified.

Choice "B" is incorrect. The paragraph should not identify the cumulative effect of the change on the audited financial statements.

Choice "C" is incorrect. The auditor should never explicitly state concurrence with a change. If the auditor opposes the change, a qualified or adverse opinion should be issued.

send

light_mode

delete

Question #48

Green, CPA, was engaged to audit the financial statements of Essex Co. after its fiscal year had ended. The timing of Green's appointment as auditor and the start of fieldwork made confirmation of accounts receivable by direct communication with the debtors ineffective. However, Green applied other procedures and was satisfied as to the reasonableness of the account balances. Green's auditor's report most likely contained a(an):

- AUnqualified opinion.

- BUnqualified opinion with an explanatory paragraph.

- CQualified opinion due to a scope limitation.

- DQualified opinion due to a departure from generally accepted auditing standards.

Correct Answer:

A

Choice "A" is correct. There is a presumption that the auditor will request the confirmation of accounts receivable during an audit unless accounts receivable are immaterial, the use of confirmations would be ineffective, or the assessed inherent risk is so low that the evidence expected to be provided by analytical procedures or other substantive tests of details would be sufficient. In this example, the confirmation of accounts receivable by direct communication with the debtors would be ineffective. If Green was able to apply alternative audit procedures and was satisfied as to the reasonableness of the account balances, then an unqualified opinion could be issued.

Choice "B" is incorrect. Since Green was satisfied as far as the accounts receivable balances, there is no need to add an explanatory paragraph.

Choice "C" is incorrect. Since Green was able to perform alternative procedures and was satisfied as far as the reasonableness of the account balances, there is no scope limitation.

Choice "D" is incorrect. Since Green was able to perform alternative procedures and was satisfied as far as the reasonableness of the account balances, there is no departure from generally accepted auditing standards.

A

Choice "A" is correct. There is a presumption that the auditor will request the confirmation of accounts receivable during an audit unless accounts receivable are immaterial, the use of confirmations would be ineffective, or the assessed inherent risk is so low that the evidence expected to be provided by analytical procedures or other substantive tests of details would be sufficient. In this example, the confirmation of accounts receivable by direct communication with the debtors would be ineffective. If Green was able to apply alternative audit procedures and was satisfied as to the reasonableness of the account balances, then an unqualified opinion could be issued.

Choice "B" is incorrect. Since Green was satisfied as far as the accounts receivable balances, there is no need to add an explanatory paragraph.

Choice "C" is incorrect. Since Green was able to perform alternative procedures and was satisfied as far as the reasonableness of the account balances, there is no scope limitation.

Choice "D" is incorrect. Since Green was able to perform alternative procedures and was satisfied as far as the reasonableness of the account balances, there is no departure from generally accepted auditing standards.

send

light_mode

delete

Question #49

Davis, CPA, believes there is substantial doubt about the ability of Hill Co. to continue as a going concern for a reasonable period of time. In evaluating Hill's plans for dealing with the adverse effects of future conditions and events, Davis most likely would consider, as a mitigating factor, Hill's plans to:

- AAccelerate research and development projects related to future products.

- BAccumulate treasury stock at prices favorable to Hill's historic price range.

- CPurchase equipment and production facilities currently being leased.

- DNegotiate reductions in required dividends being paid on preferred stock.

Correct Answer:

D

Choice "D" is correct. Negotiating reductions in required dividends would conserve cash, which would be a mitigating factor in Davis' concerns about Hill's ability to continue as a going concern.

Choice "A" is incorrect. Accelerating R&D projects would use cash and impair the company's ability to continue as a going concern.

Choice "B" is incorrect. Accumulating treasury stock would consume cash and aggravate the situation.

Choice "C" is incorrect. Purchasing equipment that is currently leased would use cash and impair the company further.

D

Choice "D" is correct. Negotiating reductions in required dividends would conserve cash, which would be a mitigating factor in Davis' concerns about Hill's ability to continue as a going concern.

Choice "A" is incorrect. Accelerating R&D projects would use cash and impair the company's ability to continue as a going concern.

Choice "B" is incorrect. Accumulating treasury stock would consume cash and aggravate the situation.

Choice "C" is incorrect. Purchasing equipment that is currently leased would use cash and impair the company further.

send

light_mode

delete

Question #50

In the auditor's report, the principal auditor decides not to make reference to another CPA who audited a client's subsidiary. The principal auditor could justify this decision if, among other requirements, the principal auditor:

- AIssues an unqualified opinion on the consolidated financial statements.

- BLearns that the other CPA issued an unqualified opinion on the subsidiary's financial statements.

- CIs unable to review the audit programs and audit documentation of the other CPA.

- DIs satisfied as to the independence and professional reputation of the other CPA.

Correct Answer:

D

Choice "D" is correct. If, among other requirements, the principal auditor is satisfied as to the independence and the professional reputation of the other auditor, the principal auditor may express an opinion on the financial statements taken as a whole without making reference to the audit of the other auditor.

Choice "A" is incorrect. Whether or not an unqualified opinion is issued is not the determining factor as to whether the principal auditor must make reference to another CPA.

Choice "B" is incorrect. Whether or not an unqualified opinion is issued on the subsidiary's financial statements is not the determining factor as to whether the principal auditor must make reference to another CPA.

Choice "C" is incorrect. If the principal auditor is unable to review the audit programs and audit documentation of the other CPA, he or she is likely to divide responsibility by making reference to the other CPA in the auditor's report.

D

Choice "D" is correct. If, among other requirements, the principal auditor is satisfied as to the independence and the professional reputation of the other auditor, the principal auditor may express an opinion on the financial statements taken as a whole without making reference to the audit of the other auditor.

Choice "A" is incorrect. Whether or not an unqualified opinion is issued is not the determining factor as to whether the principal auditor must make reference to another CPA.

Choice "B" is incorrect. Whether or not an unqualified opinion is issued on the subsidiary's financial statements is not the determining factor as to whether the principal auditor must make reference to another CPA.

Choice "C" is incorrect. If the principal auditor is unable to review the audit programs and audit documentation of the other CPA, he or she is likely to divide responsibility by making reference to the other CPA in the auditor's report.

send

light_mode

delete

All Pages