Test Prep CPA Test Exam Practice Questions (P. 1)

- Full Access (313 questions)

- One Year of Premium Access

- Access to one million comments

- Seamless ChatGPT Integration

- Ability to download PDF files

- Anki Flashcard files for revision

- No Captcha & No AdSense

- Advanced Exam Configuration

Question #1

Several sources of GAAP consulted by an auditor are in conflict as to the application of an accounting principle. Which of the following should the auditor consider the most authoritative?

- AFASB Technical Bulletins.

- BAICPA Accounting Interpretations.

- CFASB Statements of Financial Accounting Concepts.

- DAICPA Technical Practice Aids.

send

light_mode

delete

Question #2

For an entity's financial statements to be presented fairly in conformity with generally accepted accounting principles, the principles selected should:

- ABe applied on a basis consistent with those followed in the prior year.

- BBe approved by the Auditing Standards Board or the appropriate industry subcommittee.

- CReflect transactions in a manner that presents the financial statements within a range of acceptable limits.

- DMatch the principles used by most other entities within the entity's particular industry.

send

light_mode

delete

Question #3

Fanny and John each own and manage their own companies. Fanny's business is manufacturing freight boxes of all types, and John's business is selling freight boxes to different industries. They decide to combine their expertise and knowledge to produce and sell freight boxes specifically designed for the new airline company that just formed in their city. Which of the following best describes the business formed by the parties?

- AA general partnership.

- BA limited liability partnership.

- CA sole proprietorship.

- DA joint venture.

send

light_mode

delete

Question #4

A sole proprietorship would be an ideal form of business to select if:

- AThe individual desired no liability beyond his capital investment.

- BThe individual wanted to be able sell the business at will.

- CThe individual wanted the business to be a separate entity from the sole proprietor.

- DThe individual wanted the business to continue indefinitely.

send

light_mode

delete

Question #5

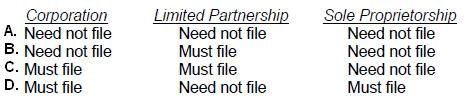

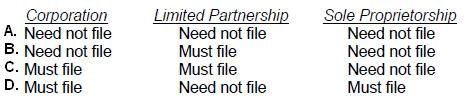

Formation of which of the following types of business does not require the filing of documents with the state?

send

light_mode

delete

Question #6

According to the FASB conceptual framework, the objectives of financial reporting for business enterprises are based on:

- AGenerally accepted accounting principles.

- BReporting on management's stewardship.

- CThe need for conservatism.

- DThe needs of the users of the information.

send

light_mode

delete

Question #7

According to the FASB conceptual framework, the usefulness of providing information in financial statements is subject to the constraint of:

- AConsistency.

- BCost-benefit.

- CReliability.

- DRepresentational faithfulness.

send

light_mode

delete

Question #8

Parker, whose spouse died during the preceding year, has not remarried. Parker maintains a home for a dependent child. What is Parker's most advantageous filing status?

- ASingle.

- BHead of household.

- CMarried filing separately.

- DQualifying widow(er) with dependent child.

send

light_mode

delete

Question #9

In which of the following situations may taxpayers file as married filing jointly?

- ATaxpayers who were married but lived apart during the year.

- BTaxpayers who were married but lived under a legal separation agreement at the end of the year.

- CTaxpayers who were divorced during the year.

- DTaxpayers who were legally separated but lived together for the entire year.

send

light_mode

delete

Question #10

Barkley owns a vacation cabin that was rented to unrelated parties for 10 days during the year for $2,500. The cabin was used personally by Barkley for three months and left vacant for the rest of the year. Expenses for the cabin were as follows:

Real estate taxes $1,000 -

Maintenance and utilities $2,000

How much rental income (loss) is included in Barkley's adjusted gross income?

Real estate taxes $1,000 -

Maintenance and utilities $2,000

How much rental income (loss) is included in Barkley's adjusted gross income?

send

light_mode

delete

All Pages